Bakken and the other shale is declining after a few percent recovery. The sharp decline is a composition effect, it is all preexisting trends, the price fall has had no effect. There hasn’t really been any correlation between price and production, you are simply not decomposing the fields.

Venezuelan oil production is currently crap because Venezuela is currently a crappy place to be. That’s a political problem, not a geophysical barrier.

Saudi oil production is running around 10 million barrels of crude per day, which number is roughly half of what the US consumes. How are you defining “small fraction”? Also note that the Saudis (and the rest of OPEC+) have quite deliberately and sharply reduced production to support prices in the face of declining demand.

Please explain your fixation with “liberals.” Are you trying to say that liberals will survive longer than conservatives? (Given per capita disparities in energy consumption, that’s not unexpected, but I’m not quite following what you intend your argument to be.)

The Ghawar oil field was discovered in 1948 and started production in 1951, producing “real oil.” (Incidentally, the figures I gave do NOT include oil shale reserves, which have been estimated as exceeding 6 trillion barrels, or about four times the 1.6 trillion barrels of crude oil.)

I don’t even know what you are trying to say here, as it makes no sense. What oil “should” exist but doesn’t? What “immediate total collapse of society”? Who are you defining as “global proletariat”? Are ANY of these thoughts actually based on your own research and consideration, or are you parroting somebody else?

I don’t know exactly what you mean by “decomposing the fields,” but yes, there is a LOT of correlation between price and production. When prices are low, producers don’t bother to complete new wells that won’t be cost-effective, and sometimes producing wells are mothballed. When prices are high, more expensive wells are brought or retained online. This is Economics 101.

For example, this spring’s oil price crash is causing the rig count in the Bakken formation to drop sharply, as it dropped sharply during the last oil glut. In April, the largest producer in the Bakken stopped all drilling and shut in (closed) most of their wells, because of low prices. (cite)

But like I said, economics is made up and in reality the collapse is exactly what would happen due to the wolfcamp hubbert curve, reserves, and physical reality as opposed to paperwork reasons. Obviously oil is being made still even in the worst profit conditions. It simply follows the curve. Companies are mostly non rational and simply obey the physical limits to the resource.

Simply ignoring preexisting trends and saying closures are new.

Your Venezuela comments again ignore physical reality. Magically we are to pretend starvation is the cause and not the result of symmetrical hubbert curve math.

Again not really understanding that saudi production is a small part of us consumption. Perhaps you think 10m is significant globally.

The other points seem indirect and or non relevant. Like, it would be more useful for you to provide your own projections. Hubbert curves mostly show Saudi peaking in 2030, Venezuela taking a long time to recover and the other producers being smaller. The long term curve is smooth over hundreds of years of course, I am just talking about the current annihilation of all liberal life. Whether they are liberal or conservative is immaterial, all will die.

The permain started around 2000. This is all predictable from decades ago. In the past there was always another field to stop the collapse. 1929 and 2008 were coal peaks, 1950, 56, 1958 were geopolitical things leading to minor recessions, 1971 was the us oil peak, 75 was Russia, 79 was us gas peak and accelerating Iranian decline. Russian decline accelerated in the 80s, 97 was Indonesian peak which accelerated to the point were global production fell in 2000. 2005 was a Siberian peak. 2015 was a Bakken peak. By properly decomposing the fields and grades and seeing how each contributes to total prodcution you can perceive the pattern. All of these could be predicted decades in advance and went exactly as planned.

There are even further detials here to flesh out. Saudi EOR raised its prodcution in the 80s, it started a new curve. If there are any times the hubbert curbe appears to fail there is likely some new grade or new curve starting. Even geopolitical events could probably be decomposed into food and population cycles. I just haven’t bothered.

It is all entirely predictable from the underlying actual geo-chemical basis and trends of the earth, global warming follows cycles of cosmic rays and sunspots, and let’s not even start.

It happened with Enron and Lehman Brothers. The practice is known as off-balance sheet accounting. It is a legal business practice and is covered by both GAAP and IFRS. However, it can be used for dubious purposes, especially if the counterparty to the off-balance sheet transactions is an offshore entity.

Here’s a decent brief overview:

Here’s the paragraph you should be reading to understand that study:

FYI, here’s the link again.

https://www.sciencedirect.com/science/article/pii/S1057521914001070#bfn0160

The last paragraph you’re referring to is a footnote. Here’s what’s being footnoted:

You’re citing the sarcastic scorn of one of the 20th century’s greatest economists towards credit creation theory as proof of the validity of magical money creation.

So your understanding of the study is incorrect, you’ve failed to point out how it is identifying a catastrophic flaw, and the you’ve gotten the quote you’re trying to use as a cite backwards. Is there anything else you want to be completely wrong about?

Your study in no way discusses regulatory failure. It hypothesises that modern banking regulatory theory is based on the financial intermediation theory and argues that there is a more correct economy theory - the credit creation theory. That’s like saying that a bridge designed in 1900 was catastrophically flawed because Einstein later had a better theory of gravity than Newton.

Oil costs money to produce. Drilling rigs, pumps, pipelines, and all the other equipment, plus the crews required to operate them, are not free. How much it costs to get oil out of the ground and to the refinery varies depending on the type of oil, the geologic features in which it is found, the physical conditions (offshore typically costs more than on-shore; Alaskan tundra costs more than west Texas scrub), the distance and mode of transport to the refinery, etc., etc. For example, if a particular well costs $40/barrel to operate, when that oil brings $80/barrel at the market they’re making money hand over fist, while at current market conditions they’re breaking even at best, and when market prices are lower, they’re losing money. A different well in a different field may be profitable at $25/barrel; yet another may not break even until the oil fetches $65/barrel.

Oil companies exist to make money. If they don’t make money, they must either figure out how to stem their losses or they go out of business. If a given well is losing money because it costs more to operate than the oil can be sold for, then the well is likely to be shut in (unless shutting in costs more, which can happen in certain environments). Oil companies answer to the same economic constraints as other types of businesses: unprofitable wells, just like unprofitable restaurants or stores or airlines, get closed.

Economics is the study of how goods and services are produced, distributed, and consumed, and how the people involved behave and make decisions. You may disagree with particular theories or interpretations of these behaviors, but in what sense are the actual facts of production/consumption and decision-making “made up”?

Show your math. Venezuela has about 300 billion barrels of oil in proven recoverable reserves; based on 2019’s rate of production (918,000 barrels/day), that’s enough to continue producing at current level for about 895 years. However, Hubbert’s curve predicts that the maximum rate will decline over time, so production will actually be stretched over a much greater timeframe.

However, we’re assuming that Venezuela is currently producing at the maximum level physically possible, regardless of economic or political constraints, and there is no reason to believe that is true. In particular, the Venezuelan oil industry has suffered for years from underinvestment as monies were siphoned out of the notoriously corrupt national oil company, US sanctions made it hard to buy parts and equipment, and foreign operators were wary of the political situation. Yes, oil production does obey certain physical imperatives: if the pumps are not working because they broke down and spare parts aren’t available, the oil isn’t coming out of the ground.

Given that 10 million barrels/day is around 10-12% of total global consumption, and about 50% of US consumption, yes, I do think it is significant. Why do you believe it is not?

Why? Human life is not dependent on oil. Current industrial life largely is, but this is a brief interlude in the history of humanity. The first commercial oil wells date only to the mid-19th century, and as late as World War I, oil was still a bit player on the world stage. As you note, the long-term curve is smoothly downward over several centuries; even if we are at or near peak oil production now, we have time to adjust. That is not to say there will not be hardships and dislocations along the way, but the species being wiped out by a lack of oil is not realistic. For example, it was the huge increase in mechanized transportation over the course of the 20th century that has driven the worldwide oil market, and about two-thirds of oil production goes into cars and trucks and ships and planes. What will transportation look like in the 22nd century? We can make some predictions about how fuel efficiency standards and the rise of electric vehicles (often powered by electricity from wind and water and the sun) will change consumption patterns, but new technologies and patterns of living can drastically alter those patterns. The rise of American suburbia after World War II increased oil consumption (needed lots more gas to commute to work), but commuting will in many cases be replaced by working from home; how much impact will that have? How rapidly will battery technology improve to store solar energy for use at night or on cloudy days? Will the emerging Chinese and Indian middle classes want US-style SUVs and pickups guzzling fuel, or are they going to be buying a lot more subcompacts and electric scooters? Large cruise ships can use 80,000 gallons of diesel per day; post-pandemic, how many large cruise ships are going to be sailing? etc., etc., etc.

1971 was the US oil peak, huh? Then please explain why US crude oil production in 2019 was nearly a third higher (4.46 billion barrels, versus 1971’s 3.45 billion barrels). Perhaps the predictions have not gone quite as according to plan as you think.

Your disagreeing with an experiment

Credit creation theory literally means magic free money

Just using ghawar an example, starting a new field in venezuela takes 20 years to hit 4m barrels per day. Of that 265 billion most wont recover, if it produces at the level of saudi Arabia since 1950 it will only provide a few percent of global supplies. It is irrelevant. Venezula cannot save the world. The other 1.6 trillion barrels of glboal reserves include a lot of countries peaking in the next few years. It’s not really math, it’s just empirical data on what happens with every other field. Iraq and iran are the only ones with decent growth to 2060 or so and those are small producers. Canada is a marginal producer that tracks US production mostly.

Again the peak has to be specific to a grade. Saying us conventional oil didn’t peak in 71 is wrong.

Oil companies do go bankrupt constantly: it is often described as one of the most moronic of all businesses and a massive scam. Just because the oil industry as a whole is valuable doenst mean the actual executives are. And let’s decompose those fields

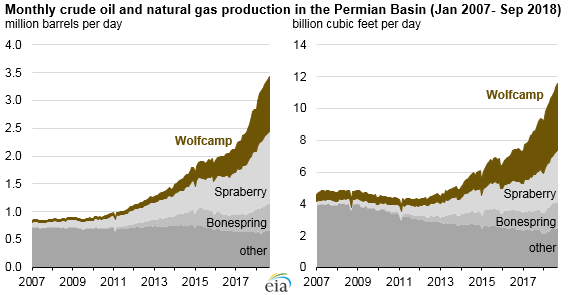

Wolfcamp has been doubling yearly, that’s why it is having a sharp crash. Wolfcamp has been making the slow growth in other fields and once it dies the whole thing goes down fast.

I’m too lazy to graph this it out but it is visually apparent.

The concept of oil price is meaningless because oil is it’s own input. Cheaper oil means cheaper equipment so it doesnt matter. The real determinant of oil prodcution is physical elemental reality which constitutes the universe.

Oil prices are due to short term factors like corporate decisions and politics, they are not related to the ability of companies to produce oil. Even if they were most oil companies are negative cash flow and will continue anyway. Oil companies do not need to make money because banks already lend at negative risk free interest. Even if the interst rate is positive they are losing money after risk.

The reason economics is made up is that your version of it ignores things like oil prices being irrelevant as determinants of production.

Now you are getting into renewables, which I’m guessing is where you go after oil. Wind growth is nearly dead everywhere except Texas. Solar energy growth is pretty minimal. Furthermore, a lot of this a tradeoff. Solar crowds out farmland. Wind energy kills birds which kill locusts that destroy farmland. These energy sources dont actually produce net energy gains a lot of the time, its just that they are currently too small to be noticeable. I dont have any data to show you because renewables are too small to have any effect right now. Texas gets 20% of its electricity from wind and the other states get even less. Denmark gets 50% of its energy and is less than 1% of Europe’s population. Even these places depend on imports and aren’t bearing the cost of the infrastructure to produce wind with their domestic economy.

The eroi estimates dont include roads as far as I know. Say a turbine requires a mile of road. A million turbines is 10x the interstate highway system. It’s also 5x the mileage of high voltage lines in the entire us. The infrastructure requirements are absurd and that’s why they are never mentioned because they destroy the viability of renewables.

Electric vehicles existed before gasoline. People prefer to spend eelctrcity on better cars. Evs are a sign of oil depletion. They are a regression. Lithium cannot be profitably mined directly, its reserves are a few million tons and at crustal abundance if 1 lb costs $1 now it will cost 100,000k from common rock. A simple ev car would cost millions. Lithium is a byproduct of tin and other mining activities that are near peak anyway. It is not a real mineral that is worth mining seriously.

You could create trolleys or some alternate system but that doesnt even matter because of the infrastructure problems with renewables. Of course there are some renewables like hydro and geo or wood that might work but that is reducing society to a antediluvian level.

Technically true, but the Fed has to get involved, and the US doesn’t really import all that much food. IIRC, most food production is domestic.

The bigger danger is the impact that fed actions are having on the stock market. It’s creating investment zombies, and I’ll concede that the degree to which this is happening has been a bit of a surprise to me. I thought he Dow would eventually climb down to about 15000 or - not forever, but for long enough for investors to really be in closer touch with reality. I see the current surge in stocks as a really, really bad sign, and that once the market finally wakes up to reality, stock markets are going to crater - perhaps in ways we’ve never imagined.

OK, let’s add natural resources and commodities to the list of things the OP doesn’t understand.

What is common rock

Hootie and the Blowfish

I was going to say Metallica, but I’ve never been really in touch with the rock scene so I could be way off.

Clearly you know nothing of geology.

Ghawar is in Saudi Arabia; it started producing just three years after discovery. Can you explain how/why this is an example of how it takes two decades to start a new field on a different continent?

Why not? These are “proven oil reserves,” which the EIA defines as “Estimated quantities of energy sources that analysis of geologic and engineering data demonstrates with reasonable certainty are recoverable under existing economic and operating conditions.” It’s not that Venezuela has 300 billion barrels of oil in the ground, but that they have 300 billion barrels the industry is confident can be recovered. You seem to think the industry experts are wrong; why?

Why is ten to twelve percent of global supply irrelevant? (And Saudi Arabia has produced a greater percentage in the past.)

Peaking, however, does not mean or imply an immediate catastrophic decline, and a decline over a period of decades gives us plenty of time to adjust, if we have the interest and willpower to do so.

What grade, specifically, do you think peaked in '71, and what is the significance of that? Different grades produce different mixes of distillates and require different refining processes, but ultimately gasoline produced from Tapis is not somehow fundamentally different from gasoline produced from Canadian oil sands.

Cheaper oil means cheaper transportation. Relatively little equipment production is directly fueled by oil. In the US, for example, most industry relies on electricity produced from natural gas or coal; in China, it’s mostly coal; in parts of Europe, nuclear power is the main source. The costs of these are only weakly correlated with that of crude oil. That means the steel used in oil refineries and drilling rigs and pipelines doesn’t somehow magically become so much cheaper just because the price of oil went down, nor do the refinery employees and rig roustabouts see their wages cut.

The real determinant of oil production is a complex interplay of physical realities, geopolitical realities, and economics. Focusing on only one of these gives you a very distorted and inaccurate view.

Oil companies need to make money because they need to attract capital. Why would anyone (including banks) give money to high-risk, low-reward companies if they have better alternatives in the form of lower-risk companies that actually make money and don’t go bankrupt as often?

This is simply a false statement, based perhaps on your misunderstanding of how the industry works. I’ve already provided cites of oil companies shutting down wells because of falling oil prices: oil price goes down, production goes down. (When oil prices go down, it’s usually because supply exceeds demand, so production also doesn’t need to be as high.)

New projects in nineteen states added 9.1 GW of new wind generation capacity last year, being the single largest source of growth in electrical generation across the country. Several states, including my own Kansas, now generate a third or more of their electricity from the wind.

Worldwide, electricity generated from wind energy grew increased by 12 percent in 2019, while solar increased by 22 percent. (cite)

Sure there’s trade-offs. Every form of energy involves trade-offs. You think oil spills don’t kill wildlife, or refinery pollution doesn’t degrade human health?

No, what’s absurd is the notion that each turbine requires a separate road and a separate high-voltage line. Wind farms, for example, group together a set of turbines with a common infrastructure, such as shared roads and transmission lines. Look at photos of the San Gorgonio Pass wind farm in California, for example: 2100+ turbines (the number fluctuates over time, but has been declining as newer, taller, and more efficient units replace older models). Do you see anything even remotely approaching 2100 miles of road, or of high-voltage lines? No, you don’t; the wind farm feeds into a single 500-kilovolt transmission line.

Could you please provide a few paragraphs explaining this ascertain? I think I have a decent understanding of credit creation theory and its theoretical impacts on money supply. Likewise I have some understanding of regulatory reporting, including banks’ capital reporting requirements, because I have actual experience of working on those reports. However, I’m happy to concede I’m not an expert and much of my knowledge is based on personal research or from asking questions to actual experts. If you have expert knowledge to back up your ascertains, or even a good level of journeyman knowledge, I’m sure you’ll be able to provide a short brief qualifying your statement.

What is the reason you’ve moved on from banking to oil and then on to alternative energy? Are you finding catastrophic flaws in every major industry?