I’m not sure exactly what tax breaks are applicable for farm use diesel in each jurisdiction, but total taxation for road-going vehicle fuel is dramatically higher in the UK at around 100%, compared to about 10% in the US. So probably much more incentive to cheat in the UK, and much more incentive for HMRC to catch cheats.

“Red” diesel is currently around 85p per litre, while road-going “white” diesel is more than twice that.

A farmer would also pay VAT on that price, but that can probably be offset.

The IRS has agents who work at truck stops in ag areas who do exactly that.

Cool. When I lived rural adjacent many folks said, “Yeah, there’s an enforcement program but it’s been 20 years since any of us have seen an agent.”

Was that bravado, stupidity, local reality, or good luck? Hard to say. I’d hope this stuff, like all taxation, was enforced hard enough to discourage most cheating.

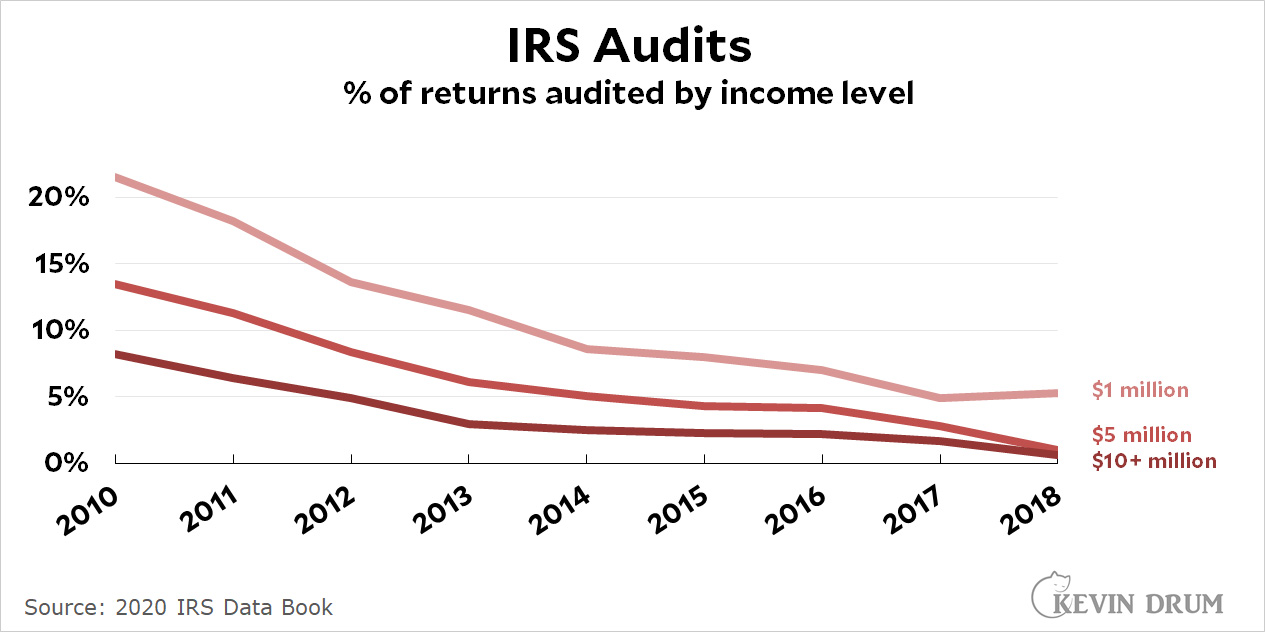

Could be, “Valid empirical observation”. Due to budget cuts, IRS activity fell off a cliff last decade. Chart shows declines in percentage of high income returns audited as an example.

Yes, gasoline for on-farm use was free of a number of taxes, and I have friends who grew up in rural Canada back in the day, who described when younger being pulled over regularly to check for “purple gas”. Also, that some of these yahoo twenty-year-olds would do things like drive into a farmer’s yard late at night, and if the filler hose was locked, hammer a hole in their gas tanks (usually elevated so they didn’t need to pump to fill vehicles) and when they’d caught enough gas, hammer a plug of wood into the hole.

When I got rid of the oil tank in my old house and switched to electricity, there was a local organization I participated in that was happy to take tank and remaining contents. They used deisel equipment on private property, but the fellow mentioned the revenue people would be “unhappy” if they saw that home heating oil was being used for vehicles.