But that’s priced in, too. I mean, that condo has a big HOA fee for a reason. And if you put a 15 year old house on the market with original appliances, original HVAC, original interior paint, original flooring, orignal hot water heater, etc., your only buyers will be flippers. The comps you see are for updated houses.

Not around here, where bidding wars are routine and houses sell in a matter of days. Obviously, though, if the place is visibly decrepit it will not bring the best price, but I don’t intend to let anything go to that stage. As for condo fees, sure, but I’m not talking about financials in that context – I’m talking about the fact that the major thing becoming decrepit around here is me! ![]() I’m going to need low maintenance!

I’m going to need low maintenance!

Kinda sorta relevant to this discussion – this is specifically about Canada, but some of the dynamics may also apply to parts of the US:

Bottom line: one of the reasons for dramatic price increases recently is that there are simply not enough houses. This is probably at least partly connected to an influx of immigration. Another change that is affecting values is a shift from traditional big price appreciations in urban areas to the suburbs, some of which have seen bigger price rises than anywhere else, particularly the suburbs surrounding big cities.

Missed this one.

It’s too early to tell. But …

- We didn’t buy a very large house, and/but/so we leaned toward high-quality, likely long-lasting components wherever we could (buy once, cry once)

- Weather, usage patterns, and a lot of other things will play a significant role

But my guess is that you’re probably right.

If that’s the case, though, the surplus will go to a worthy cause: better single-malt. I simply can’t lose ![]()

Terrible choice! Fine wines, my boy, fine wines is where it’s at! ![]()

We bought a five year old house. We’ve been here 20 years now. In that time, we have:

- Replaced the shake roof with asphalt after the shakes rotted. $20K. Replacing with new shakes would have been $40K.

- Replaced two furnaces with high efficiency ones after the originals failed. Plus we added A/C. $22K

- Re-did our backyard patio, where annual frost heaves had caused all the pavers to either sink or tilt. $15K

- Replaced all appliances other than washer and dryer. $5K

- Finished the basement. $30K with me doing all framing and electrical.

- New water heater. $1200 installed.

We have huge floor to ceiling 2-story windows across the back of the house. They are argon-filled, low-e triple pane windows, The seals are now failing, and we’ve been told that replacing the windows will cost at least $40K. For now we had them re-caulked and hope to get a few more years out of them.

Our back deck needs new dura-deck, and probably new plywood. Probably $3k-5K.

Our house needs new carpet, but so long as we have two dogs and a cat we are holding out for now. Probably $15K to redo it all.

The house will have to be repainted before we sell it. No idea what that will cost.

Our in-floor heat in the basement has a failing water heater, and the whole system has to be replaced as it no longer meets new code. At least $10K.

This is pretty average stuff, with no huge ‘gotchas’ we didn’t expect except for the rotting, supposedly 40-year shake roof. Once we do the other work that should be done, that will be about $150K of work in 20 years.

A friend of mine bought a house, and after a couple of years noticed the doors and windows were starting to stick. It turned out that one corner of his house was sinking. He had to hire an engineering firm to mud-jack the house and stabilize it with pilings driven very deep. It cost him $70K, and the house itself cost about $250K.

In the meantime, our house has declined about $200,000 from its high value of about $780,000 over the last decade. It’s still worth significantly more than what we paid for it, but once you add in all the maintenance and upgrades it’s barely breakeven, after 20 years. If we had purchased this house in 2010 at its peak, we’d be facing a major loss.

Real estate as an investment is a boomer thing, because they lived through some huge runups in housing prices, starting in the 70’s. My mom bought our half-duplex for $18,000 in 1974, and within a decade it was worth $80,000. She sold it for $120,000 a few years later. It was basically all the wealth she had.

But in my entire life here in Edmonton, real estate has been at best a wash. There was one period between about 2000 to 2010 where real estate went up quite a bit, but if you bought in at any other time you probably broke even at best, and would have done much better putting your money in other investments and renting.

Own a house because you want to own a house. For a primary residence it can make sense financially. Owning a house as an investment is a crap shoot.

I heartily endorse this advice. I’ve been perhaps a bit smug about real estate because I’ve owned in what’s been basically a hot market for more than 30 years, but that’s certainly not the case everywhere. In general, one should think about home ownership in terms of quality of life – the neighbourhood, the ability to do what you want with the place, stability, etc. The financial appreciation should be considered a bonus. I have never set out to own a house for the purpose of getting rich (which I ain’t, anyway) but mainly for those previous reasons, with the thought in the back of my mind that it’s also financially wise. And so it has turned out, to a degree much greater than I expected. Also, I’ve inherited some of my ultra-paranoid parents’ suspicions of financial markets. Not everything is a Bernie Madoff ripoff, but there are lots of “managed funds” out there that charge high management fees and could, quite literally, be better managed by a pack of monkeys. I do believe in index funds, though, although you can still lose big if your timing is unlucky.

One thing I will say about owning a house: It forces you to save in the sense that you aren’t spending the money you have to put into the mortgage on pure consumption.

Let’s say renting a place costs $1500/mo, but instead you have a $2000/mo mortgage, $500/month in property tax and you spend an average of $500/mo on maintenance. If you have the discipline to rent and put the other $1500/mo away in investments you will likely come out way ahead in 20 years.

But most people don’t have that discipline, and instead will spend that $1500/mo on a nicer car, vacations, etc. Then they get near retirement and have no savings. Owning a house forces you to build equity - unless you do something stupid like take out a 40 year mortgage.

It also encourages you to keep saving even when you really, really don’t want to: it’s not just nice cars and vacations that eat away more liquid savings, it’s things like living expenses when you are un- or underemployed.

And it’s not the 40-year mortgage that is the problem, it’s the taking out a home equity loan every ten years or so.

One thought: If your parents MUST Invest in something tangible, look into land that is currently “in nature’s state”, but will likely be surrounded by developments. This way, they have the option of a small vacation or retirement home, and can anticipate rising value.

Thanks, good thoughts.

The other thing I’ve been suggesting to my parents is a real estate investment trust (REIT.) I have only a rudimentary understanding of them but basically AIUI you put the money into it, someone else handles all the headache paperwork and management, and it will pay dividends of typically 3-7% annually.

But my mother will have none of it. Houses!!!..she is very much a house person, no amount of my persuading her that property taxes and hidden costs will eat away any rental income she could get.

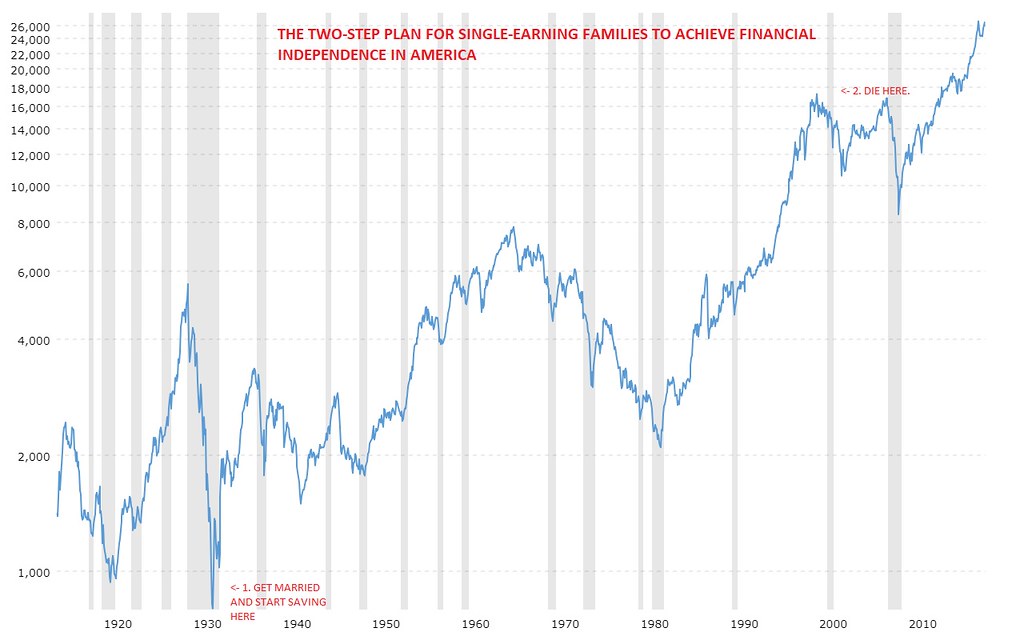

Well, he is wrong as this simple chart shows.

It’s the DJIA, inflation adjusted, drawn on a logarithmic scale.

My grandparents bought and sold at the two red points. Started investing in 1931, died in 2001. Pretty good, right? They died very wealthy for a family whose head of household was a general manager at a Charleston, WV sporting goods store.

But what about that guy who started in 1935 and then died in 1980? How did he do? Well, he lost all appreciation from everything purchased from 1946-onwards. His gains rest on his performance from 1937-1946, but if he reinvested those gains into the 1946-1980 stock season as stock experts insist he should… ![]()

That guy didn’t just lose to inflation, he lost to the stock market itself. He got fuckin’ killed. And my God, those poor souls (you know they exist) who started buying in at 1965 and then rode the downslope to their early heart attack in 1980.

So, yeah, the premise is wrong as with most premises which imply ‘every time’, ‘at no period’, or ‘it has never’.

In the 2020s, a bet on housing is a bet on continuing increasing wealth inequality and political dysfunction. Yes, housing is “too expensive” but where people go wrong is assuming that things that are overpriced will go down in price and things that are underpriced will go up. This doesn’t happen in a diverging market, instead, the more overpriced something is, the more it goes up because the quantity of people who want that housing increases faster than the essentially fixed supply.

Imagine you went back to 2010 and built a consensus crowdsourced list of the most overpriced real estate in America. People were absolutely certain that places like San Francisco, Manhattan, and LA were absurdly, stratospherically priced. But a portfolio of those areas would have far outpaced any list of “promising bargain up and comers”. Even within those cities, the most crazily overpriced homes have done better than the average homes.

The difference between then and now is that the list of overpriced real estate in 2021 is essentially any city with economic prospects anymore. The cause of this has been amply documented in any number of left leaning wonk blogs but the real relevance to you is whether there’s anything that could reverse the course on these trends or will the forces continue to accelerate?

Thus, the question at the heart of buying any property “worth buying” these days is essentially, is the current trajectory of increasing wealth disparity and oligarchic takeover of political power across the globe something you think can ever be fixed or is it a freight train too powerful to ever be stopped?

If you rent a place of the same size and quality as you buy, how is your landlord going to avoid paying $1,000 a month in taxes and maintenance, making his effective rental income $500? In any case in 20 years your rent will no doubt be $3,000 a month, while your mortgage will not change.

I assume your numbers are Canadian dollars? We paid less than $22K for our new A/C and furnace, and that involved replacing the ductwork to support AC and running heat to the parts of the house that didn’t have it.

We hadn’t needed A/C in the Bay Area for the previous 24 years. Thanks, climate change!

The A/C should increase the value of the house (it increased the value of ours for tax purposes) so that could be a plus.

How big is your house? Ours is a bit over 2,000 sq ft, and we’ve maybe spent $60K over 25 years, including new carpet, painting, new windows, extending the hardwood into the addition and repiping the drains… It’s from the early 1950s, so maybe they built them better back then.

It’s gone up 5X in value from its absurdly high price 25 years ago, so I’m not complaining.

Only if Republicans win back their majority in Congress

To qualify as the safest and best way to invest, the stock market simply needs to be safer and better, on average, than the alternatives.

So, yeah, the premise is wrong as with most premises which imply ‘every time’, ‘at no period’, or ‘it has never’.

The statement doesn’t imply that.

It’s the DJIA, inflation adjusted, drawn on a logarithmic scale.

My grandparents bought and sold at the two red points. Started investing in 1931, died in 2001. Pretty good, right? They died very wealthy for a family whose head of household was a general manager at a Charleston, WV sporting goods store.

But what about that guy who started in 1935 and then died in 1980? How did he do? Well, he lost all appreciation from everything purchased from 1946-onwards. His gains rest on his performance from 1937-1946, but if he reinvested those gains into the 1946-1980 stock season as stock experts insist he should…

- If you’re investing a percentage of your money every month then it’s not quite accurate to simply point at two red dots on the chart. (Granted, the two dots technique is the one under discussion in this thread).

- Stock valuation is not always a good way to value the market. As an example, let’s say that you bought LQD at $103, back in August of 2002. On November 16, 2018, the value was $112. From the value, you’ve only had a profit of about 8.7%. Assuming a flat 2% rate, I believe that inflation would be 13.9% for the period - you lost money on valuation compared to inflation. The actual return, including dividends and reinvestment, would actually be 21.27%. the value was less than half the calculation of the total return (in this case).

- The stock market - especially today - is not just “stocks”. Meaning that it’s not just investing in partial ownership of US for-profit, publicly traded companies, one by one. You’ve got REITs, ETNs, bond funds, inverse funds, options funds, foreign markets, etc. And if you’re willing to expand the definition of “the market” to just be any product that you can get through a bank or brokerage, then you’re also gaining access to things like annuities. If your only goal is to beat inflation over the long run, and you’re willing to wait there and do research, crunch numbers, and compare options, you should be able to accomplish that to a very high degree of certainty.

To qualify as the safest and best way to invest, the stock market simply needs to be safer and better, on average, than the alternatives.

This. Ultimately, all investment vehicles - including real estate - tend to take a dive at the same time. The only true hedge is to have a percentage of your assets invested into something that shrank less than what all most other people were invested into. That’s all profit, from the standpoint of living in this world.

The stock market - especially today - is not just “stocks”. Meaning that it’s not just investing in partial ownership of US for-profit, publicly traded companies, one by one. You’ve got REITs, ETNs, bond funds, inverse funds, options funds, foreign markets, etc. And if you’re willing to expand the definition of “the market” to just be any product that you can get through a bank or brokerage, then you’re also gaining access to things like annuities. If your only goal is to beat inflation over the long run, and you’re willing to wait there and do research, crunch numbers, and compare options, you should be able to accomplish that to a very high degree of certainty.

And even stocks are diverse. You’ve got large caps and small caps. You’ve got relatively volatile stocks and less volatile stocks that pay good dividends. I owned a different mix at 35 than I do today at 70.