Just to be clear, the last recession (often referred to as The Great Recession) ended in he summer of 2009, having lasted for ~18 months. We have not been in a recession since then.

The downward trend of wages adjusted for inflation has been happening steadily since around 2000 (according to the source I mentioned upthread); I think some posters are referring to that more specifically. The relationship between the data you are mentioning and this data could be a whole other thread topic(and probably has been, more than once). I think you make a good point in mentioning this though.

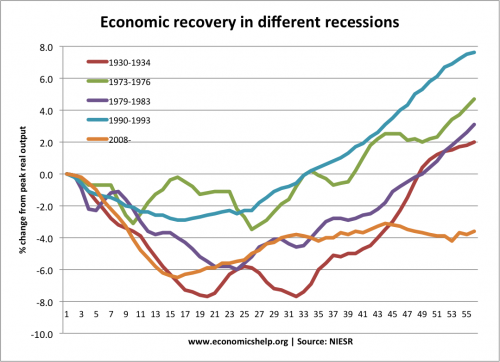

Technically, you are correct. But Wesley Clark has lots of company. This is by far the slowest, weakest recovery in living memory (perhaps ever)–enough so that a lot of people think the recession never ended.

Here’s a chart showing a visual comparison.

And another one, in some ways better.

http://www.cbpp.org/images/chartbook_images/2.1.2-cumulative-loss-OPT.png

To the best of my knowledge, the only person I know who makes as little as $15 per hour or less is my babysitter. The vast difference in our life experiences is a great example of why you need to look at actual data, and not assume anyone with a different experience than your own has a wildly-distorted view of reality.

And they are also wrong. If he told us evolution was “just a theory”, he’d have lots of company, too. Remember, we’re supposed to be fighting ignorance, not spreading it. ![]()

I won’t disagree. In fact, I had originally intended to put that in my post, but didn’t. Yes, this is a very weak recovery. But we’re not in a recession.

In the field I work in the term “Labor Burden” means all expenses the company has to pay that is above what the worker gets in his pocket. That is SS, vacation, holidays, dental, medical, pension, workman’s comp, etc.

When I started a couple years after college at one specific company the labor burden carried was 26.5%. I performed hundreds of estimates there and that was what we carried for labor burden.

Now years later that same company, carries 37.75%. As said this will vary state by state and from one company to another. The point I was making is there is a significant expense above the pay a worker receives in their pocket.

Personally I think what Americans are experiencing isn’t part of the normal cyclical business cycle of booms and recessions.

First of all, the 2008 financial crisis was a major correction due to unsustainable problems with our fundamental economic system. Specifically, the ability of thousands of unqualified homeowners to obtain mortgages for homes they couldn’t afford and then for banks to repackage those mortgages and buy and sell them such that they had what were essentially huge paper assets on their books.

And secondly, there has been a much longer-term economic trend of declining real wages and increasing income inequality cased by a combination of globalization, outsourcing, disruptive technical advancements and resource depletion, which has been exacerbated (or has exacerbated) health care, education costs and debt.

I’ve heard it said that your salary will about equal the average of your four closest friends… So, um, get higher paid friends.

Technically you’re right, of course. But the reason people think we’re still in a recession is that income growth has been distributed unevenly.

Cite

We’re doing better than Europe in terms of recovery - but I don’t know if the bottom 90% or 50% is doing better.

Not exactly. Income could be distributed “unevenly” and most people could have nicely rising wages. However, that’s not the case. It’s because income growth, in absolute terms, has been low for most people. I don’t think most people feel bad if the rich are getting richer, as long as they feel they are moving up the socio-economic ladder, too.

ETA: I think that’s more along the lines of what you meant to say, but what you actually said was a different.

I think the quoted portion covered this nicely. 5% increase and 4% increase is uneven - 31% and 0.4% is worth talking about. And, more relevantly the group getting a 0.4% increase (which is also spread unevenly) can be excused for thinking we’re still in a recession.

To me $15/hr is low. I started at $17.50/hr in 1987.

The things you mention have some part in this, but it is more a matter of moral will, I think. The mortgage issue was due to a lack of regulation, sometimes a willful refusal to regulate, and the acceptance that anything that might hurt the immediate profitability of banks was a bad thing.

While people claim that unemployment and stalled income come from a skills mismatch, actually those with the skills are usually not doing all that great. If corporate profits were down that would be one thing, but they aren’t. Now we’ll hear that just because a company made record profits doesn’t mean the workers deserve a raise - but that is exactly the moral issue I’m talking about.

In 1890 I were getting twenty-five shillings a week, and I would have considered half a million quid a year princely.

Kindly Andra Carnegie was getting $25 million a year ‘take home pay’ in 1890, equal to £5 million.

Makes you wonder where all the money goes.

The folks that wait outside Home Depot in my neighborhood ask for $25/hour. Some will negotiate but that’s about the going rate. Depending on your age and where you live, I’d be surprised if you didn’t know people who made > $15/hour.