Avoid the whole Last Will & Testament problem. Have your attorney set up your finances so that he expects to receive a call/text/email from you once a day. If he does not hear from you for 72 hours, he liquidates everything and donates it to a charity you’ve selected.

There was a really old Jerry Lewis movie, where his doctor tells him he is dying, has only 6 months to live. What to do? Go overseas, live it up in Europe on his credit cards, in the days when credit card billings took a while to get across the ocean and cancelling credit cards took months.

Then his doctor has a hasty meeting with him in Spain to say, “oops, the lab made a mistake. You’re OK.” Hillarity ensues with faked death, coffin mix-up (widow of old Kentucky Colonel says “can I see him one last time”, open coffin to find what should have been Lewis by mistake, except is purchased Spanish corpse - man is black…)

Could a person just totally ignore their family and say give it all to a charity?

Generally, yes. It’s best to specifically state in the will that you are intentionally not including them, to make that clear.

In many places, this doesn’t apply to a spouse – laws may require that a spouse gets a certain portion. In fewer places, this may extend to children, too.

From my law school recollection (and this is not my area of practice) any clause which would require a beneficiary to divorce a spouse is void as against public policy.

As far as the racial or religious marriage clauses (he shall inherit so long as he marries in the Jewish faith) jurisdictions are split: with some saying that it is the testator’s privilege to give an inter vivos gift on those grounds, so why not a testamentary one, and those jurisdictions which void these clauses as a matter of public policy.

So, for your other hypos, I would argue that once a beneficiary marries someone not in the class the testator specifies, his gift lapses because to marry another would require a divorce which is against public policy and/or the testators wishes were for the initial marriage to be with a member of the class.

As far as the requisite amount of “Jewishness” again, the basic test is the will of the testator…and if it gets too nitpicky it might tip the balance as against public policy.

Replying to an old post, but

It’s my understanding that, in Ohio at least, this is not quite correct: The executor’s fiduciary duty is to the estate, not to the beneficiaries. The interests of the two can be different, especially if there are creditors involved.

As for “all of the heirs agreeing” to avoid a convoluted will, the catch is that it has to be all of the heirs. In the classic millionaire-makes-his-relatives-play-a-twisted-game scenario, there’s also a provision that if the relatives can’t or won’t play the game, then the entire estate goes to some silly charity, instead (or in at least one literary case I know of, the American Nazi Party). In that case, the charity would also have to agree to any change to the will, and they might be much less motivated to do so than the relatives are.

The estate doesn’t “sit in lawyer limbo.” It sits in administration. A well-written will will (if you’ll excuse the phrasing) invariably include language addressing likely (and even unlikely) contingencies. “To X, so long as he marries a nice Catholic girl by age 35,” etc.

But even if the date of the possible distribution is open-ended, that doesn’t mean the money is in limbo. It is held in trust by the executor(-trix) until the distribution is complete. If the executor’s fees eat the remaining estate before that occurs, well, whoops.

So long as the conditions of the distribution do not violate the Rule Against Perpetuities (or its statutory equivalents), it doesn’t matter how long it takes for a distribution plan to be completed.

As noted in previous posts, there are of course public policy restrictions on how a testator arranges his will - but here’s an interesting Illinois Supreme Court case on how those public policy limitations can be “avoided.”

Because a lawyer can’t prevent a client from doing something unwise, and has limited ability to prevent a client from doing something that is actually illegal. And the sort of wealthy client who goes to a probate attorney with will stipulations like these is likely to say, “you’re the bigshot lawyer, make them enforceable.”

So there’s no need to create an actual specific trust entity, even for an extended duration? The money sitting in the trustee/executor’s trust account is sufficient? I assume it can’t sit in the client’s account, since the bank will probably want to close those sooner rather than later once there is no longer a client?

(Sorry, I was always under the impression that there was a certain amount of paperwork to create a longer-term trust fund. After all, someone must have to pay taxes annually on the money the investments might earn and all the other paperwork associated with money and taxes. You’re saying it can just sit in the lawyer’s general trust account if necessary?)

speaking of Jerry , his will just came out and he specifically said the 6 kids from his first wife get nothing.

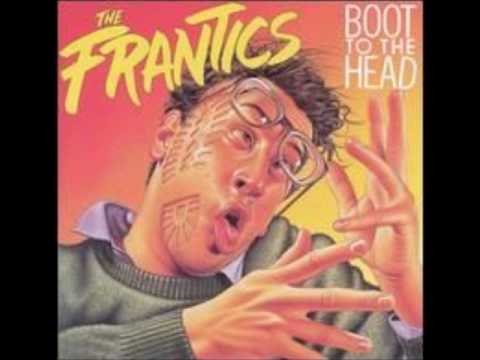

What movie was this? The plot sounds very similar to Living it Up, but in that movie he went on his spree in New York City, not Europe. Seems strange that there would be two Jerry Lewis movies with such similar plots.

Oh sure, make me look it up.

Hook, Line and Sinker 1969 - caution, spoilers in summary.

Funny, it’s not like Lewis would beat a joke to death, would he?

That was back when $100 Billion was real money!! ![]()

It would certainly suck to live in a place like Puerto Rico just now and finally get power & comms back after a month of sweltering and starving in the muddy jungle near the wreckage of your house only to learn that now you’re flat broke too since your lawyer didn’t hear from you for 3 days and gave away all your money.

Even if you don’t have comm problems there’s still an issue.

If the attorney took any action with your money after your death without a proper estate that’s a violation of law. So it becomes a race between when he gives it away and when your date of death is determined to have been. So what you need to do is go radio-silent for 3 days, then have him give it all away, then have you turn up freshly dead at least the next day and be reliably provable to be freshly dead. As in still warm.

A much simpler fully legally provided-for option already exists. Pay-on-death / Transfer-on-death (“POD/TOD” in the argot). Almost any financial account, such as a bank or brokerage account can have a designated beneficiary/ies who’ll get the money upon the account owner’s death. This happens 100% outside of probate and the transfer is made almost the very day the institution gets legal proof of death. There’s nothing wrong with selecting your local cat shelter or old wino’s home as your POD(s); it/they don’t have to be a relative or even a human.

You can even set up real property this way so your house, farm, whatever pass directly to whoever/whatever you want while still fully bypassing the probate process. These docs are commonly called “beneficiary deeds” but some states may have different terms. There are some restrictions on POD/TOD for passing IRAs and 401Ks.

Regardless of any of the above, the value bypassing probate will generally still be part of your estate for federal estate tax purposes. Unless you’re at least sorta wealthy that’s not an issue under current law. But many people are surprised to find out the decedent’s probate estate and their federal estate tax estate are two very different piles of money, law, and paperwork.

Bottom line: The legal industry has already sorted out most of the sensible ways to do this stuff. Many lawyers, including my wife, can tell you horror stories of people who thought they’d “outsmart the system and do it the easy simple ‘common sense’ way.”

Instead they ended up screwing their surviving spouse or family to the wall when for just $5 worth of forms from the library they could have accomplished the same goal according to the rules, rather than in ignorance-based direct contravention of them.

DIY outta-your-ass “estate planning” is right up there with DIY appendectomy as a really, really stupid conceit.

DIY estate planning guided by actual books by actual experts is OKish if your family and your life (and death) are simple enough and there’s not much money involved. Recognizing that to po’ folks, even $500 is enough to fight your own brother to the death over.

Right, it seems “Bob gets the money once he marries a nice Catholic girl, if he hasn’t by time X then the money goes to Cat Rescue” would be fine. But “The money goes to Bob, but if he ever divorces his his nice Catholic wife then money goes to Cat Rescue” would not be. It would have to be “If Bob has not divorced his nice Catholic wife by time X then he gets the money, else Cat Rescue”. Once Bob gets the money, it’s his money.

One way for this to work would be “Bob will have the right to live at Lemur Manor as long as he is married to his nice Catholic wife. After time X if he’s still married to her, he gets Lemur Manor. Else, Cat Rescue.” Another way would be “Bob gets $X per month as long as he doesn’t divorce NCW. After X time, he gets the full trust, if !divorce NCW, else Cat Rescue.”

You can actually do that with real estate, though. It’s called an estate in fee simple subject to executory limitation. If Bob divorces, title to the land automatically vests in Cat Rescue.

Woah! Talk about handing the Nice Catholic Wench serious leverage!