One issue is that most cash drawers have five coin slots; one each for quarters, dimes, nickels and pennies with the last used for rolled coins or stamps. Merchants don’t want to handle dollar coins because their systems aren’t set up for them. But if the penny is eliminated, there’s room for the dollar coin.

Actually, in my experience it’s more interesting than that. I usually tend to think of pocket change as “not real money” like you say, which means that I tend to buy stuff like cokes, etc… without really keeping track of it- if I have change, I spend it, and if not, I don’t.

On trips to Europe where they have 1 and 2 Euro or Pound coins, I found myself spending considerably more profligately as a result- I still thought of my wallet as where the “real” cash was, and my change, as well, change. So I’d be burning through the single and double coins without even really thinking about it, like I would if I had to pull my wallet out and look at how many bills I had left each time.

All that said, I think the mental adjustment would come about fairly fast- 6 weeks (my grad school study abroad) just wasn’t quite enough for me to adjust.

And to whoever said that there’s no reason you should ever have more than 3 $1 (or euro or pound) coins in your pocket- that’s what $5 notes are for, have you never ended up with more than 6 quarters in your pocket for some reason? Do you go exchange 4 of them for a $1 note when you do? By your logic, there’s no reason to have more than 3 quarters either, but we all end up accumulating change and then spending it down.

I do not see the logic here. How is it any more inconvenient to spend pennies than dollar bills? How does it make any sense at all to let them pile up? That seems foolish, not sensible.

You seem to be saying that the effort of using coins is so great that it is not worth your time for less than a certain amount. This can’t be the physical effort, as that is miniscule, so it must be psychlogical. WHY is it so burdensome? I find it simple. Why do others find it difficult? I can see that it is an issue, but not why. Can someone please articulate the problem?

If I use a $20 bill to buy something that costs $12, I’ll get $8 in change. I’ll carry that $8 with me, because at some point in the future that $8 could mean the difference of being able to buy something or not. That is to say, I could be $5 shy of having enough cash to purchase that round of beers if it weren’t for the $8 in change that I chose to shove into my wallet.

If I use a $20 bill to buy something that costs $12.81 and get $7.19 in change, carrying that extra 19 cents means nothing to me in terms of my purchasing power. I will never, realistically, be within 19 cents of not having enough cash to make a purchase. I will always be able to cover that 19 cents with an additional dollar bill. Choosing to carry those 19 cents has absolutely no affect on my purchasing power.

On top of that, I could be carrying that 19 cents around for days or weeks before I make another cash purchase where I can actually pay some portion in change. During that period, it will clang around in my pocket, possibly get lost, and generally just be a nuisance while bringing nothing useful to the table. Therefore, I make the calculated decision to relieve myself of this (admittedly minor) burden by taking the (also minor) step of dropping all change into a cup by my front door. I’ve not once regretted this decision, by which I mean I’ve never said to myself, “Arg, why is all of my change in a cup by my door?! Now I can’t do X!!!”

Thank you! I think I understand now.

For me, “money” is the category that makes the difference between whether I can buy something or not. The coins, bills, etc., are just the pieces of the transaction. I don’t care what combination I have, other than trying to minimize redundancy.

It sounds like other people think of each unit separately. Under that system, I can see that pennies, nickels, and dimes make no sense to carry, and quarters only for laundry. It’s a rather foreign worldview, but at least it makes sense now.

I would expect a similar hatred for single dollar bills to crop up in a few years: the number of things you can get for $1 or less is dwindling fast.

I’m already in that category. I used to be the type of person who would roll my eyes at someone buying a $4 lunch with plastic. But now that most small transactions don’t require a signature, I use my cards for everything, including $1.19 sodas at a gas station. That’s how much I dislike carrying cash. I’ll actually leave dollar bills at home now if I have too many. As long as I’ve got a couple 20s for emergencies I’m satisfied. I’ll use cash maybe twice a month, if that.

It’s been said before, not sure if in this thread, that plastic will solve the penny problem once and for all. I now believe that to be true.

The lira wasn’t a “worthless” currency. It was, of course, possible to buy all sorts of services and goods with lire; you just needed more units of lira than units of dollars. That means, however, only that the individual monetary unit was worth less; it didn’t mean that the currency as such was worthless. That would be like saying that the mile is a superior unit of measuring distances simply because the same distance, measured in miles, will be expressed in a smaller figure than if expressed in kilometres. It’s, ultimately, just a figure which gains its meaning only by being linked to an arbitrarily defined unit of measurement. As has been said by others, there is absolutely nothing inherently superior to a price of $10.99 as compared to ¥1099, where $1 = ¥100.

I would also like to point out that, legally, the U.S. dollar has, since its beginning, been subdivided not only into 100 cents but also 1,000 mills; the mill is a legally defined monetary unit. Nonetheless, there have never been mill coins in circulation. That’s another reason why I doubt that redemonination, rather than a phase-out of low-value coins, would be the preferable response to inflation.

Well, I don’t think space on price tags is a resource whose scarcity is perceived as a particularly pressing problem, so I doubt this consideration will be sufficient to make Japan redenominate.

Uh… there’s room for them right now. “Rolled coins or stamps” are not exactly in high demand. People use the last coin spot for such storage precisely because dollars (and halves) aren’t circulating heavily; they have nothing better to do with it. I have noticed some shops where I spend dollars start using that bin with purpose, though.

But if we get rid of $1 paper, we’ll have register room for $2s.

So you think that over the course of the next century or two, as the price of a thimble edges towards Y400000 that people won’t think to themselves, “Hm…maybe we should do something about all those digits in every price”?

I wonder if change usage is a generational thing. For the first 28 or 29 years of my life I had no bank card. Sure, I had a credit card, but back then you didn’t put small purchases on a credit card.

When bank cards became available for me (circa 1989) the only thing one used them for was withdrawing cash at an ATM. It wasn’t until maybe the mid-90s when merchants started to come on board with direct debit machines.

So, after using cash for decades, and working the cash register at a few part-time jobs, I was completely used to ALWAYS reaching for change first. If something came to $8.79 I would (and still do) check my change to see how to minimize getting more change.

When you work for a few years at, or near, minimum wage and cash payments are your only option you don’t throw your change in a jar; you spend it as you go and feel much better getting bills back instead of more change.

Spending the pennies once I’m standing in the store ready to pay takes no effort. But why would I dig around for pennies to take in to the store in the first place? They’re worthless.

Your argument rests entirely on speculation. Currently, there’s 124 yen to the dollar, and Japan’s inflation rate averaged 3 % p.a. over the last decades (right now it is much lower, close to 0.5 % p.a). At a rate like this (i.e., 3 %), what would currently cost the equivalent of a dollar now will cost about 2400 yen in a hundred years. These are still very manageable dimensions. Making predictions, on the basis of an extrapolation of current trends, beyond, say, a century is entirely useless: The yen as a currency wasn’t even introduced until about 140 years ago. We have absolutely no way of knowing which monetary system (if any) will exist in Japan (if the country as such will still exist) several hundred years from now.

To elaborate on that argument a little further: You’re assuming a constant rate of inflation. That’s a very questionable assumption over the periods of time we’re talking here: The 19th century was, in many countries, an era of alternating inflation and deflation, with some economies experiencing severe declines in prices over several decades. If we’re talking historical dimensions like in your argument, it’s not entirely implausible to suppose this could happen again. So to counter your argument, if the yen is redenominated, and then a prolonged deflation strikes, it’s possible that some day your thimble will cost not Y400000 but rather Y0.004. In that case, people will say “Hm…maybe we should do something about all those digits in every price by splitting the yen up into many new yens”. The point is: We simply don’t know what will happen, and that’s why it’s unwise to assume that current trends will continue in the long run, and base long run decisions on these assumptions.

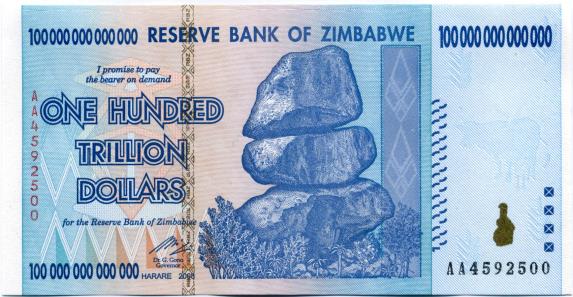

I agree that extra zeroes in dollar amounts is not a pressing problem. ![]() Of course we have two extra zeroes right now ($19 is written $19.00) which can be eliminated later in the century if they’re an annoyance.

Of course we have two extra zeroes right now ($19 is written $19.00) which can be eliminated later in the century if they’re an annoyance.

Other countries with inflation almost as bad as the Obamacare-Benghazi-Illuminati hyperinflation have managed without eliminating zeroes:

(The Germans saved a character, if not a zero, because their “billion” is our “trillion.”)

Thailand has quarter-baht and half-baht coins (worth respectively slightly less and slightly more than our penny). Big chain stores and the post office are among the few places with prices that are not whole numbers of baht, but often don’t have the coins to give as change. When buying small envelopes at the post office, buy an even number or you’ll be cheated out of a penny! ![]()

You and Leffan above are missing the point. Dollar coins are ‘heavy’ for no other reason than to signify they’re more ‘valuable’ than say…a penny. Physical size or weight mean nothing to the value, only to impressions and tradition. We left the gold standard under FDR. The trivial amounts of nickel, copper, etc., mean nothing. There isn’t any Silver or Gold in US coins (which had a weight to value relationship)

Make friggin ‘dollar’ coins the size of pennies. Hell, re-brand pennies as dollars, and we’d all be more wealthy.

Anyway, no reason not to do away with useless ‘metal’ currency (sorry purists…‘coin’) and just use bullion and or electronic value. (Yeah, I’m looking at you 'Dollar, Twenty, or whatever ‘bill’ that you spent gagzillions to perfect from counterfeiters )

Just sayin’

It’s always amusing that people get worried about being cheated out of a few pennies due to rounding to the nearest nickel, but no one seems to have worried in a long time about being cheated about rounding to the nearest penny for a long time.

E.g., sales taxes should be assessed to the nearest tenth of cent, right? But they get rounded. Even in electronic transactions.

I remember sales clerks used to have little laminate charts of what sales tax was on any amount up to a dollar. Of course it made it more noticeable when the jump of an extra penny was tacked on.

With inflation, those fractions of a cent then are worth more than a penny now. People just need perspective.

And math skills, but I’m not holding my breath.

That’s a good point–I don’t think there’s much of anything that costs less than a dime, except possibly for some of the smaller loose nails. Briefly looking at the Lowes website, I couldn’t find any for less than a dime, let alone a nickel or cent. Now some people might argue that eliminating the cent will be inflationary from the perspective of someone who has to buy one single nail for $0.25 instead of $0.23, but even for them–how often would this sort of thing ever come up?

Hardware websites are a good place to see the prices of things that you used to expect would only cost a few cents, like zinc plated wing nuts. The cheapest one I could find at Lowes, just now, is priced at $.68. Why does there have to be a coin worth one sixty-eighth of a single wing nut? Or, for that matter, even one-thirteenth, as the nickel?

It’s interesting that retailers complain that handling extra coin denominations would lead to extra expense while at the same time coin-operated machine owners and manufacturers decided to spend all kinds of dough installing paper money validators on their machines when almost all machines made in the last 20 years accept dollar coins. And older ones can be retrofitted to accept the coins for far less money than a validator costs (but yes, it was probably decided that American consumers are so freaked out by dollar coins that it was worth the expense… candy-assed panderers!!)

Undoubtedly the cost of the bill validators, and the maintenance they need on a regular basis*, has been passed onto consumers. If they had just never installed the validators in the first place we’d have a lot more dollar coins in everyday circulation and would be used to them by now. Plus we’d enjoy cheaper soft drinks, bus rides, loads of laundry, etc.

It seems very stubbornly American to choose the more expensive, impractical way of dealing with inflation instead of just stopping the whining and accepting the more logical, less costly, and, I hope, inevitable solution (i.e.: use the damn dollar coins, eliminate the paper dollar bill, and demand $2 and $5 coins as well).

- Bill validators end up costing a lot of money: