According to the study (8-page PDF) referenced in this article, and broken down into income quintiles (lowest to highest income) – all in:

Q1: 33.9%

Q2: 23.2%

Q3: 21.1%

Q4: 19.8%

Q5: 16%

[NB: and this is already a model that constitutes 50-60% of all personal bankruptcies in the US – medical debt]

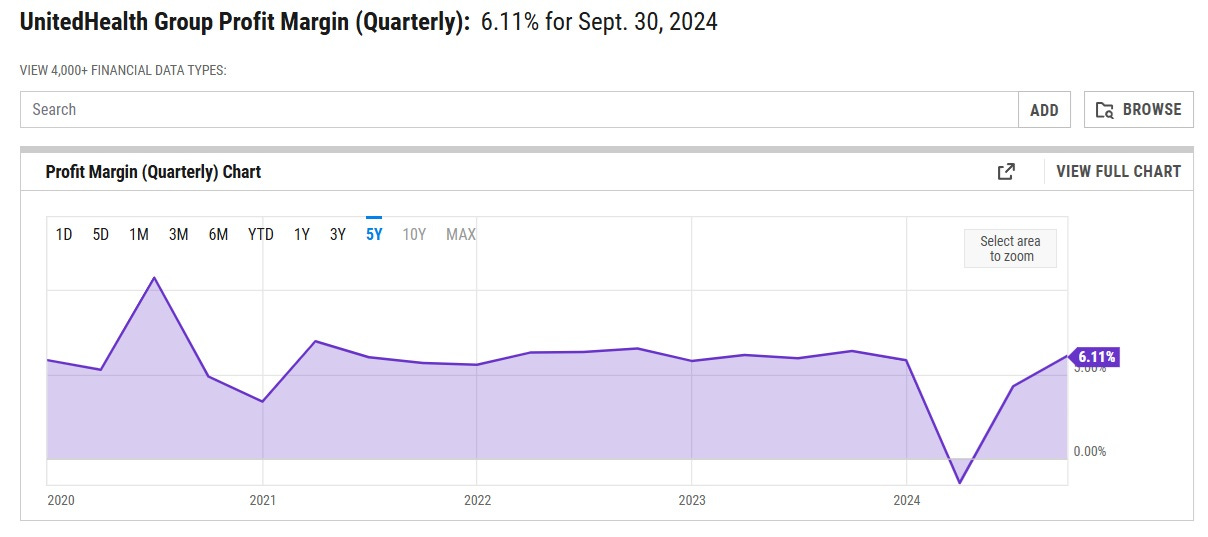

The article also details how health care utilization compares to health care expense (click link to view graph).

GRAPH

Where I think you’ll see some inequities in our current system – inequities that could be (at least, initially) exacerbated by Universal Health Care.

At least, that is, until a different model of health care financing and delivery yields better outcomes and improved health across the lower income quintiles – something that’s a serious issue, today.

A bit of salient methodology detail from the study.

Note: The payments to finance health care are the sum of out-of-pocket, premium, tax, and other payments. The dollar value of health care received reflects national health expenditures, excluding other non-durable medical products (non-prescription drugs and medical sundries) and other private revenues (philanthropy and income from gift shops, cafeterias, parking lots, educational programs, and investment income for institutions such as hospitals, nursing homes, and home health agencies).

One thing to remember: the cost of US employer-provided health insurance is not sui generis. Just like tariffs, increased cost of goods sold, increasing labor rates, and shoplifting, these are costs passed along by companies to consumers.

IOW: employer-provided health insurance is being paid for by the vast majority of American citizens … already.

Being an off-the-grid Buddhist hermit allows you to avoid that, but for most of us … we’re de facto opted in.