On the other hand, it’s a disaster for anyone chronically ill or higher than typical healthcare costs.

So, basically, the poor, ill, and handicapped are screwed.

On the other hand, it’s a disaster for anyone chronically ill or higher than typical healthcare costs.

So, basically, the poor, ill, and handicapped are screwed.

He also favors selling health care insurance policies across state lines, so the policies from states with the shittiest regulations will dominate the market, and your state cannot regulate the policies sold within your state.

Well, all righty then! Everybody else benefits, and they are no worse off!

it’s an option under ACA. Those that don’t fit the profile I described aren’t wildly screwed unless they choose badly.

That phrase there, “not risk averse”. That could cover a lot of territory. Perhaps if you explained what you mean by it.

I mean it in terms of risk aversion used in finance and economics (from wikipedia.)

Because the ACA as currently written requires that employers above a certain size provide employer-funded health care.

Those same employers saying “we’ve done some shopping for you and here are a plan or two to pick from. But from now on 100% of the cost is yours though. <cue Mr. Burns’ style evil cackle & hand-rubbing>” is directly *opposite *to one of the big thrusts of ACA.

You’re right that ACA is mostly about ensuring that folks without employer-provided health insurance now have at least plausibly affordable options they absolutely didn’t before. But it’s *also *very much about ensuring Corporate America doesn’t take the new widespread availability of affordable individual coverage as an opportunity to dump all of employed America’s health costs on those programs and onto the individual employees.

This was the basis of the mostly true statement by Obama that “you can keep your existing insurance plans.” While it wasn’t true around the fringes (thank you Republicans) it was, and is, true in the main.

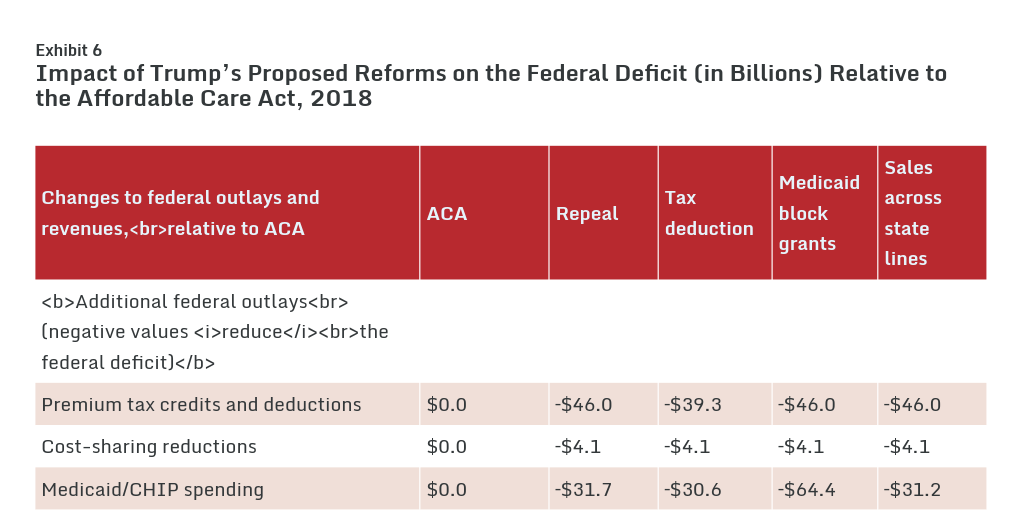

That’s lumping more together than just the effect you were asking about. There’s more detailed discussion in the “Federal Deficit” section of their findings for different aspects of three related proposals they modeled.

Doesn’t chart 6 imply that it would cost 39.3 billion a year for tax deductions due to health insurance premiums?

Doesn’t chart 6 imply that it would cost 39.3 billion a year for tax deductions due to health insurance premiums?

Doesn’t chart 6 imply that it would cost 39.3 billion a year for tax deductions due to health insurance premiums?

I like your use of the word imply. It certainly looks like it. Some of their presentation of findings made me start wondering if I was mixing up their cases, though …and I wasn’t reading through again. You were more patient than I. ![]() Still that column summed drives the number, $41b, in their overall findings as the increase in deficit as a result.

Still that column summed drives the number, $41b, in their overall findings as the increase in deficit as a result.