Definition of Terms:

Franchise - A business model which you purchase for an initial lump sum and then a split of your revenues.

Franchisor/Franchiser - The company selling this business model.

Franchisee - The person or company buying the business model.

McDonald’s is a franchiser selling hamburger franchises to willing franchisees.

Also: Long. And contains math. You don’t have to do math, I’ve done it for you, but this one contains numbers.

TLDR: Franchisers prey upon retired military personnel, many times ruining their lives. I go into detail re: one franchise ‘opportunity’, then discuss how US military personnel are especially preyed upon by unscrupilous franchise 'coaches."

This is a bit too much for the mini-rants thread as this story is replicated hundreds, thousands of times every year. Nobody talks about it, especially the victims, and yet this… crime, imho… continues.

Last night a couple I know posted on FB that they were closing their PuroClean franchise after 10 years. I know her better than I know him - part of her responsibilities was marketing their business - we met a few times, had lunch, etc, but I never had need of their services.

PuroClean is a water damage remediation service, kind of like Roto-Rooter. Never had need of their services - San Antonio is pretty dry and when it does flood, I’m on relatively high land: if the water rises to my door, it’s a FEMA-level event.

Let me quote from their Franchise Disclosure Document (FDD), a document I will quote from quite a bit:

Now I’m going to jump ahead a little bit and tell you a shocking secret about franchisers - for the most part, they’re fucking leeches.

There are two types of franchisers:

-

Those that look to draw every bit of revenue from their franchisees.

-

Those that look to draw every bit of revenue from their franchises.

The first are parasites, imposing upon the franchisee such a bevy of fees, rebates, and conditions that it is almost impossible to make money off of the businesses. At best, you buy yourself a job.

The second are actual businesses who understand that their long-term interest is in helping the franchisee succeed, thereby enriching the franchisee so they can buy more franchises.

Puroclean (PC)? PC’s FDD is chock full of charges, fees, royalties, and the worst of all, they admit to getting kickbacks from required purchases! Even payroll! Definitely a type-1 operation.

Check this shit out…

(Disclaimer: My friends agreement is 10 years old and may not match this in the particulars. This is from the Purosystems 2021 Franchise Disclosure Document downloaded from the State of Wisconsin Franchise Disclose Download page. Type in “Puroclean”, click on the one button which appears, then click on “Download” on the next page. You’ll download “Document.pdf”. All information comes from the document found on this site, 2-20-2022. He sez for the lawyers.)

The implied business model is this: Your customer gets a flood. In a panic, they call you, you come in and mitigate the services (stop the flooding and vacuum up the water). You then get to bid on reconstruction services (but you don’t have to), which generates even more revenue for you, given you are the clients already trusted PuroClean expert. (I can hear the pitch now, lol)

You get to pay Puroclean 10% of your first $250k in mitigation services revenues, this scale sliding down to 3% @ $1.75 million. You also have to pay a flat 3% on your reconstruction services revenue.

And this is fine - while these percentages are high, pretty much all franchisers get paid a percentage of revenues. It’s just how they earn after they sell the franchise.

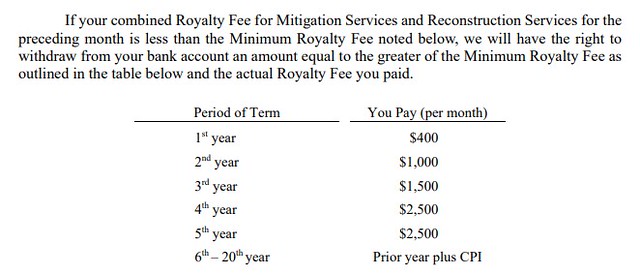

It is the other stuff which is a moral and financial abortion. For starters, they have a minimum royalty which needs to be paid regardless of business levels:

The total of this minimum… assuming a 3% CPI… is $670,000. And they must pay this even if they do not recognize a single dime of revenue.

But again, a royalty is fine. I just wonder if someone ever put together a spreadsheet for my friends and said ‘here’s what this chart means’:

| CPI | 3% | |

|---|---|---|

| Royalty Minims | ||

| Year | Per Month | Per Year |

| 1 | $400 | $4,800 |

| 2 | $1,000 | $12,000 |

| 3 | $1,500 | $18,000 |

| 4 | $2,500 | $30,000 |

| 5 | $2,500 | $30,000 |

| 6 | $2,575 | $30,900 |

| 7 | $2,652 | $31,827 |

| 8 | $2,732 | $32,782 |

| 9 | $2,814 | $33,765 |

| 10 | $2,898 | $34,778 |

| 11 | $2,985 | $35,822 |

| 12 | $3,075 | $36,896 |

| 13 | $3,167 | $38,003 |

| 14 | $3,262 | $39,143 |

| 15 | $3,360 | $40,317 |

| 16 | $3,461 | $41,527 |

| 17 | $3,564 | $42,773 |

| 18 | $3,671 | $44,056 |

| 19 | $3,781 | $45,378 |

| 20 | $3,895 | $46,739 |

| $669,506 |

So just by signing this thing, they are already in the hole $850,000 (rounded) including start up costs and royalty commitments.

And this is the OK news!

So we read beyond that, and we come to this chart, misleadingly entitled “Start up Costs”. And I say ‘misleadingly’ because a few (parts of 6, and 12-13) are continuing operations items and not what I would consider true startup costs, as the notes make clear. Other items… the training, for example… are part start up (initial training), part continuing operations (refresher training).

Footnotes:

So… I’m going to add that insurance and computer systems to the ‘in the hole’ chart above, because there is additional language elsewhere stating they are responsible for making these payments regardless of level of business:

| CPI | 3% | |||

|---|---|---|---|---|

| Royalty Minims | Insurance Software | Restoration Mgt Software | ||

| Year | Per Month | Per Year | Per Year | Per Year |

| 1 | $400 | $4,800 | 1500 | 1935 |

| 2 | $1,000 | $12,000 | 1500 | 2580 |

| 3 | $1,500 | $18,000 | 1500 | 2580 |

| 4 | $2,500 | $30,000 | 1500 | 2580 |

| 5 | $2,500 | $30,000 | 1500 | 2580 |

| 6 | $2,575 | $30,900 | 1500 | 2580 |

| 7 | $2,652 | $31,827 | 1500 | 2580 |

| 8 | $2,732 | $32,782 | 1500 | 2580 |

| 9 | $2,814 | $33,765 | 1500 | 2580 |

| 10 | $2,898 | $34,778 | 1500 | 2580 |

| 11 | $2,985 | $35,822 | 1500 | 2580 |

| 12 | $3,075 | $36,896 | 1500 | 2580 |

| 13 | $3,167 | $38,003 | 1500 | 2580 |

| 14 | $3,262 | $39,143 | 1500 | 2580 |

| 15 | $3,360 | $40,317 | 1500 | 2580 |

| 16 | $3,461 | $41,527 | 1500 | 2580 |

| 17 | $3,564 | $42,773 | 1500 | 2580 |

| 18 | $3,671 | $44,056 | 1500 | 2580 |

| 19 | $3,781 | $45,378 | 1500 | 2580 |

| 20 | $3,895 | $46,739 | 1500 | 2580 |

| Column Total | $669,506 | $30,000 | $50,955 | |

| Grand Total | $750,461 | |||

| Est. Start Up Costs | $150,000 | |||

| IN THE HOLE | $900,461 |

Pretty fucking sly how they hid $51,000 of “restoration management software” fees in a “$0” line item using the “Startup Costs” chart & a footy! Gotta give it to them, and then to do the same damn thing with their insurance software… $30k referenced as “$375”, just a ![]() 's

's ![]() of misdirection.

of misdirection.

(Oh, these FDA’s are not regulated, btw. There’s no state department of franchises auditing these things.)

And we haven’t gotten to the enraging thing yet. It just keeps getting worse.

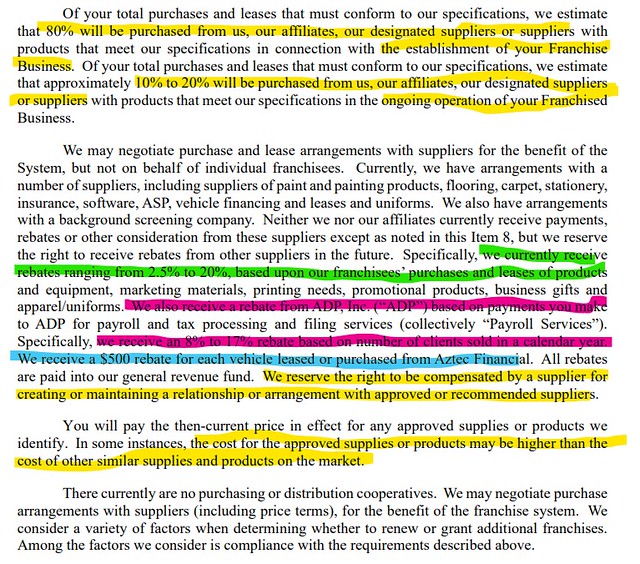

There is this page, such a cesspool of financial chicanery that I color-coded it:

Yellow (top): We expect about 15% of your COGS to be filtered through our system.

Green: We get kick backs! In other words, our suppliers overcharge you and then send us 2.5% to 20% of what we forced you to spend with them! Remember how we told you you had to spend 2% of your revenue on marketing? Some of that (2.5% to 20%) just goes directly into our pockets! Thanks!

Purple: LOLOLOL, we get a kickback on your payroll. Think your franchise is doing well, want to decrease profits by paying yourself more? LOLOLOLOL, we’re smarter than you and we have already arranged it with ADP so that you get to pay about $11,000 for every $10,000 of pay received by you. If you pay yourself $100,000, you get to pay us up to $17,000 for the privilege!

Blue: Yeah, Bill had a great idea… he said “What if we restrict vehicle purchases to some far-flung outfit in God Knows Where, owned by Who Knows Or Really Cares, Right?.. and then we charge our franchisees a flat $500 for the right to buy the truck we require of them… but we arrange it as a rebate and disclose this ONLY in the footnotes?”

Fuck, Bill, just what if you did that? It’s not like the franchisee needs that $500 - they’re already In The Hole for $900,000, what does another $500 really matter?

Yellow (bottom): Yeah, we can do this with anyone. And we’re not really concerned that ‘you can buy better stuff for cheaper’, so just stuff the talk. We. Don’t. Care.

Let me clarify this, in case I didn’t make it clear: These rebates are extra costs added to various supplies and services solely to pass through extra cash to the franchiser via collections by third-party entities and you see them in hundreds of FDD’s. Therefore, if you bought or leased a $40,000 van, you were charged $40,500 with $500 going directly to PuroClean. And you agreed to this.

So how much is stolen from the franchisees via these agreements? Well, the aggregate is given as $673k on page 20 of the FDD. PuroClean elsewhere admits to having 227 franchisees, so we’re looking at $2,964 per franchisee, per year in rebates. And over 20 years, that’s another $59k In The Hole.

A million down. Before the first dollar of revenue comes in. Not an impossible situation, not over 20 years, but it sure makes succeeding a helluva lot harder. Couldn’t Puroclean be happy with… $500k over 20 years?

So who signs these things? And, no: not “idiots”.

I don’t know how my friends became involved in this franchise, but upon learning about it back in 2016-17, I became interested in the topic of franchises and did a fair amount of research into these FDD’s, seeing what made for successful franchises and ‘troubling’ franchises*.

And I also saw an ad. For a “franchise expert” giving a lecture at UTSA about franchising and the military. It was free, so I decided to join and attended this “class” one morning.

I walk in, about 12 people there by the time he started. He immediately wanted to know who was military, asked if any of us had any franchise experience before, and he went into his ‘lecture’.

He starts off with a slide show about the great, wonderful world of franchises, with all the charts showing growth, Growth, GROWTH, here’s a picture of Ray Kroc of McDonald’s, look at all these famous brands, famous because of the miracle of franchising.

Already my suspicions were raised. Then he continued in a speech so stupefying that I haven’t forgotten it since 2017, when I first heard it.

You know, I never had the pleasure of serving, but my brother, Joseph, did. Served in the Navy, was in the Persian Gulf for both Iraqi actions, retired after 20 years. And he and I were talking and he told me this:

“Dave, the hardest thing about civilian life is that there is no Civilian Book like there is a Navy Book. In the Navy, you know that if you did things by The Book, you would have a good career, and there were many times when, faced with a decision, I went by the Book… and was never, ever disciplined for that. Rewarded even. And now… I’m on my fourth job in 7 years, and I just wish there was a Book.”

Ladies and gentlemen, that’s why I do this – to help people like my brother Joseph. Because there is a Book for how to succeed in the civilian life, and companies like Subway, McDonald’s, and others have perfected it. You invest in a franchise and you invest in a Book of Success, winning both the military and the civilian lifestyles.

He slowed down the pitch after this, saying because he was in a University he couldn’t go on too much (nudge nudge) but feel free to take down his contact information (wink wink) or just wait for him to reach out to you via the contact sheet you innocently signed when you entered the room (nod nod)

For someone who is feeling lost in the Bookless civilian world, such an appeal is quite powerful. Get to be a boss by following the Book and enforcing the Book? “Own” a business, the sine qua non of American capitalism? Where do I sign up? I’ll always have my pension!

5 months after seeing this con artist, my neighborhood HOA gets into a fight about some auto repair franchise being built next to our neighborhood. The principal franchisee was, again, a military veteran with absolutely no P&L experience (I know because I asked. I then had to explain what I meant by “P&L” (Profit and Loss.))

The garage went belly up after 3 years. Both he and his wife were working there full-time and I bet this, a business where she and her husband were putting in a combined 100+ hours, was not what she signed up for.

And my friends? Also ex-military. Also, probably, with no P&L experience, possibly being pitched this franchise after being “scored” and “evaluated” for the “best” franchise by one of those franchise brokers, a person getting his cut of that lifelong $1 million “In The Hole” amount.

It’s a goddamned tragedy. And I know of four veterans who have fallen into this trap, not to mention the ones who just convince themselves to start a drywall company or similar trade. But the drywall guys are in a much better position than the preyed-upon franchisee – they can close their business with no future obligations whatsoever. A franchisee effectively just throws $200,000 and more… to buy a thriving business at best, a job at its most typical outcome, and financial ruin at worst.

The franchisee is sucked dry, even if they served this country. Especially if they serve this country. While 7% of all US adults are veterans, according to the Census Bureau, 14% of all franchisees are veterans according to Vetfran.org. And the most current studies have franchise success rates between 62-80% after five years[/url], meaning… at best… 1 in five fail, and 1 in 3 at worst. (Unfortunately, not finding statistics which break this down by military status.)

In researching this article, I found another one! It’s the same story – he doesn’t know anything about the business, but he found a ‘franchise coach’ who was willing to help him make a decision. He loves the structure given by the franchise, and he is starting his 20-year journey in, effectively, buying himself a job.

I feel like reaching out to this guy saying “No! Stop! Didn’t you read about the rebates?” And the beauty of it is, he also is doing this in San Antonio, in the wealthier areas around Boerne and Comfort. So, Puroclean lost a military franchisee and picked up a military franchisee. They got theirs: the game continues.

Anyway, I just wanted to rant about this totally predictable disaster. I hope they didn’t come out of it too damaged: these are good people, they didn’t deserve this. And while I understand the “they’re adults and signed the agreement, etc” argument, the fact remains that human beings who serve our country are specifically preyed upon by these craven businesses via having their fears, dreams, and desires weaponized against them, many times to their impoverishment. And it’s about time somebody, even some rando on a message board, took notice.

JT

*An aside too important to throw out: You can identify worthless franchises rather easily via two simple FDD metrics: (1) How many franchises are owned per owner? (You want 3 franchises per owner, minimum) and (2) how lengthy is the section detailing lawsuits in relation to the size of the franchiser? (You have some company you never heard of with 5 pages of lawsuits, just throw that shit away. If McDonald’s just has 5, it’s probably a quiet year.)