I keep seeing commercials, ‘buy gold as a sure-fire investment’ - OK, I buy a gold bar. Suppose there is some apocalypse where cash money is no good, or I lose everything in a flood, and I own nothing of value in the world. But I own a gold bar stored away, I guess, in a bank? What do I do? Call them up, direct them to sell the gold, and send me money? Because I can’t go around buying gas or a Wendy’s baconator with a gold bar. I know it sounds stupid, but I can’t quite grasp the process, is this what happens if paper and coin money is no good (or I don’t have any)?

Well, yes. Frankly if the economy fails to the point where money is not good, then gold wont be of much help either, a better investment would be ammo and canned goods.

However gold is a commodity and you can invest in it like the stock market.

One slightly fun way to invest in gold, usually not available with stocks (altho some companies do have nice certificates) is to just buy 1/10th oz US gold coins, or old $5 gold pieces that have no real collector value.

Then you can at least look at those and admire them. I have a few sovereigns and they are nice to look at.

Honestly if the economy tanks so bad that cash is worthless, and you do have a large stash of gold coins, some guy with a gun will just kill you and take them.

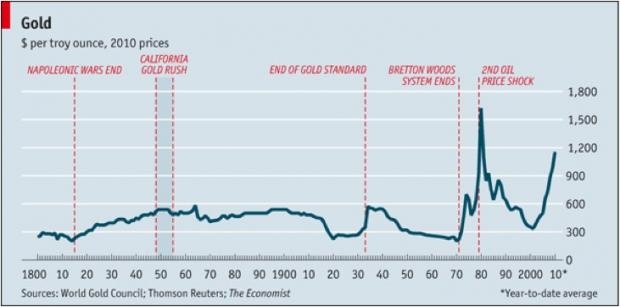

Gold peaked in October with an all time high just north if $2000 an ounce. Now its in the mid $1800 range, so not heading the way that you would like to see. With a more stable (i.e. predictable) US government now in charge this may be the time to wait and see how low it goes.

Buying gold because of fear of some impending apocalypse is really the domain of unhinged conspiracy theory nutters. Reasonable people who invest in gold do so either as a hedge against inflation or the belief that it’s undervalued at some particular point in time; in that sense, it’s no different than currency trading or investing in any other commodity.

You’re mixing up a couple of different questions here.

First, buying gold as an investment. You can buy bullion and keep it in a safe. You can also invest in various other instruments like futures, mutual funds, ETFs, stocks of gold mining companies, etc. When it’s served its purpose, or you just need the cash, then you sell it. The best reason to do this is as a hedge if you think inflation is going to spike soon, but there are other ways to achieve that.

Second, your implied question is how gold can be resilient as a store of value and means of exchange in total financial collapse situation. Bluntly, it’s only as good as your ability to locate like-minded people who are willing to trade food for gold. You might get lucky enough to find some fellow gold bugs, but almost 100% certain they will be wanting to unload gold for food, just like you. So there’s no good reason to hoard bullion unless you just like to touch it and look at it sometimes. I have a few gold coins specifically for that purpose.

Just remember - the ones telling you to buy gold are not doing that themselves. Instead, they are selling gold.

Gold actually has a iffy history for investment. There are some minor issues with it too if you are actually buying physical gold. The stuff is heavy but easy to steal.

A fairly safe but good way to invest is to either invest in an Index fund and/or solid dividend stocks and set it up for auto-reinvestment of the dividends.

Growth Stocks are usually more volatile and a little bit more like gambling. Also with the chance that there will be a correction sometime this year, it isn’t the best time for such.

I bought shares in two gold ETFs in recent years: GLDM (one year ago) and IAU (a few years ago). The IAU shares never really went anywhere, and I ended up selling them and reinvesting earlier this month. The GLDM shares I bought in February 2020 have gone up 17% in that year. So if you wanted to invest in gold, I’d recommend an ETF, not bars or coins. GLDM and GLD seem like solid choices.

I am not a financial advisor, just a guy who likes to dabble here and there to pass the time, FTR.

Without endorsing those ideas, I’d note that a lot of gold bugs dislike the concept of “paper gold” and believe that in times of trouble (particularly the times to trouble that holding gold is supposed to protect you against) ownership rights of those ETFs will not be honoured, and you’d be no better off than if you were holding paper currency.

Just remember that an apocalypse does not have to mean a global apocalypse. Currencies collapse all the time. Governments fall. War and crime happen everywhere and often. That’s before you factor in things like supervolcanos, floods, and aliens.

Here’s a plausible scenario for you. Your country’s leader loses an election, claims illegitimacy, and tries to maintain power by declaring martial law. All those people in the streets, protesting, are declared domestic terrorists and rounded up by security forces. Pogroms ensue. The world watches this with abject horror, and immediately declare all kinds of sanctions against your country’s banking system while the private sector heads for the door. Your local currency’s value plummets.

It gets so bad, other countries are airlifting their citizens out of their embassies. Bombs are falling, and the government is coming for people like you. You need to get out. You run for the border and claim asylum. They grant it.

Now how are you going to feed yourself? Your paper currency is worthless and your bank account is locked. It’s literally illegal for your new host nation’s banks to accept a transfer from embargoed accounts. Sure would be nice to have some living expenses saved in some sort of universally accepted, fungible commodity accessible from any nation in the world, wouldn’t it?

Does that sound far-fetched? Or does it sound like Germany 100 years ago? Cuba 60 years ago? Venezuela 2 years ago (and now)? Or the US just 3 weeks ago?

The whole world doesn’t need to collapse for your world to collapse.

Of course, in any scenario like that, physical possession of bullion metal will be worthless unless you have the armament to protect that possession. I suspect there’s a huge overlap between “survivalist goldbug” and “survivalist gun fan”.

I bought gold a long time ago in the form of a ring that I used as a prop for my wedding. I don’t wear jewelry, so the ring was worn for the length of the ceremony only.

Shortly thereafter the price of gold increased dramatically, and shops opened up offering to buy it.

So, being a rational sort of dude, I turned my ring into more cash than I’d paid originally!! I thought my wife would be happy, but nooooo, there’s apparently something called “sentimental value” that I hadn’t considered.

I don’t remember any of that, and my US bank accounts are still accepted everywhere just fine. You might be experiencing something more locally. Like in your head.

You don’t, in fact, invest in gold. You speculate in it. You buy some, and then for reasons completely unpredictable, it’ll either go up or down in price. You hope it’ll go up, in which case you win, but maybe it’ll go down, in which case you lose. It’s fundamentally no different from a casino, except that the casino plays faster and charges lower fees.

Dow Jones Industrial Average since 1900:

This is in support of Chronos’ post, not as a rebuttal, in case any confusion arises.

Yeah. The people selling good want that worthless paper you have, for some odd reason…

There’s generally a fairly large period between “society functioning normally” and “bands of roving scavengers sifting through the remains of past civilization”. The goal is to convert gold into something more useful like canned food or ammunition somewhere along that glide path.

After the asteroid obliterates Eurasia, gold will not be particularly useful. Legal documents proving pre-asteroid ownership of far off gold less useful still.

=(sigh) thank you for the answers, I see this commercial with some old bat from Texas buying gold to insure her spawn benefit from all those gold coins. But you can’t use it IRL, that’s the part I don’t get. IF worse comes to worse, if inflation goes sky high, if you have a gold bar, what good does it do? How do you get any value out of it, or gold coins, or even a stash of gold jewelry?

Any midsize city will likely have at least one coin dealer who will give you money in a variety of currencies for gold by weight (or more if the coin itself has value above melt).

In an apocalypse scenario, follow the smell of roasting meat and get ready to gesture and bite your gold to show its quality.

I disagree. If you need, for example, to have enough to get started again in a new country, or to feed your family for a while until things return to normal, you don’t need so much that you can’t conceal it from random thieves. You’re not going to live off of it forever, it’s just going to keep you alive until you can make money again in the regular way.

Typically, investing in gold is sort of like investing in bonds (if I understand correctly) – you don’t buy them to make a profit, you buy them to protect the profits that you have made with your stocks. When stocks go south, bonds retain or even gain in value. You can’t spend bonds in a catastrophic scenario, but few people sneer at them; you might at least be able to get some survival value out of your gold (or, for smaller purchases, junk silver coins).

The current price of gold rose from the 1200-1300 range to 2000 in fairly short order, then has apparently settled down to around 1850. Of course no-one knows where it will go next, gold bugs may think that a Democratic administration will lead to inflation and therefore that gold would be a good investment. But you wouldn’t have had to buy gold very long ago to have made a huge profit, even if you sold it today instead of October. But again, that doesn’t make sense to me as a reason to buy gold, because it is unpredictable and doesn’t happen very often.