Well of course it just gets monopolized in a small nunber of banks that cross-hold and therefore effectively own each other and are a single monopolized entity.

Either there’s something very wrong with this statement or I know much less about finance that I think I do. I feel like a dog that’s just been shown a card trick.

No its yours to invest. You can multiply it into 10x more m1 and invest it or lend it to a shell company to invest for you.

Do you think banking regulators would notice if a bank somehow made quadrillions of dollars magically appear through the use of shell companies?

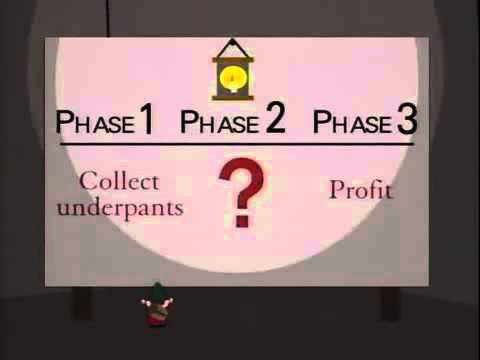

Again, you seem to be skipping over some steps.

I already stipulated that I’ve invested $1 million in something that returns 5% annually.

So after the first year, I have $50,000 and I owe $1 million.

That is not “infinite” money.

What’s my next step?

Do you promise to throw us a big party with your first million? (You can always reinvest 10% of it.)

That’s a wrong reading of how the reserve works. You don’t take the amount of money in the reserve and then multiply up to a larger amount. You take the total mount of money you have and divide down to the reserve.

Let’s call ten percent to keep the math simple. You’re a bank and you receive a hundred million dollars in deposits. You are required to keep a ten percent reserve on hand, so you hold on to ten million dollars and loan out the other ninety million.

It’s true that the total amount of money you have is equal to ten times what’s in the reserve. But the total produced the size of the reserve; the reserve didn’t produce the size of the total.

If you decided to keep a higher reserve, let’s say twenty million rather than ten million, you wouldn’t change the size of your total assets. Doubling your reserve does not double your assets. The total stays at a hundred million. You’ve just changed it from ten million in reserve and ninety million available for loans to twenty million in reserve and eighty million available for loans.

[quote=“Riemann, post:87, topic:823134”]

Am I the only one thinking of this?

[/QUOTE]That’s enough. If you want to engage in debate on the merits, go ahead. But since the post about gold fringe, you’ve stopped doing that and are … not exactly trolling, but something akin to it.

If mustang19 wants to make an argument, address it on the merits. Sovereign Citizens, etc. is off topic as well as far as I can see so let’s drop that too.

[/moderating]

I understand that. I was just asking someone to explain the concept of th “Multiplier” that is in the wiki in my original post. I know wiki is just a bunch of schmo’s on the street typing whatever they want, but I have seen the concept before, and could not figure out what it meant. If you say it is dead wrong, then I will believe you, but I am thinking that I am just looking at the concept wrong. And I trust the schmo’s on the Dope before I ever trust the schmo’s on Wikipedia. Here is the wiki again: Fractional-reserve banking - Wikipedia

You don’t have infinite money. You have less money than you started with. Because that depositor didn’t give you $1000. It’s still his money and any time he wants he can get his $1000 back. Plus he gets the dollar you gave him. So he ends up with $1001 dollars and you have a dollar less than you started with.

The way you come out ahead is that when you have the $1000 you turn around and loan other people $100 and tell them they have to pay you back an extra dollar. So you loan ten people $100 each and they all pay you pack $101. You now have $1010. The original depositor asks for his $1000 back plus the extra dollar you promised him. You give him $1001 and you get to keep the remaining nine dollars.

But you never had infinite money. With the $1000 you could loan ten people $100 each. You couldn’t loan fifty people $100 each because you didn’t have the $5000 that that would require. The total amount you can loan out is the amount that’s been deposited with you - $1000 not infinity. If you wait until the first round of loans is paid back, you’ll have $1010 and you can now loan out that much - but still not infinity.

All a fractional reserve changes is that instead of being able to loan out the entire $1000, you have to keep $100 of it in your wallet and can loan out the other $900. It’s still not infinity.

This is starting to sound like some kind of banking Ponzi scheme.

First of all: 10%, not 3%, is the standard reserve requirement. The 3% rate is just a “loss leader” on the first $X to encourage small banks to apply for federal charters. I don’t know what the reserve requirements are for state-chartered (non-federal) banks.

In particular, “banks” operating without regulation can loan out ALL their deposited cash if so inclined. (cf. Charles Ponzi et al). Viewed that way, “fractional reserve” is NOT a privilege granted to regulated banks, but rather an obligation they must satisfy for the benefits of being chartered.

Stop right there! You’ve got it backwards. When customer withdraws the $1 in cash, the bank becomes delinquent in its reserve requirement. The Fed doesn’t give it $1 (let alone the mint give it :smack: ) The bank must deposit $1 of m0 with the Fed to fulfill its reserve requirement. It will be scrambling on the telephone hoping it can use some of its assets as collateral to borrow $1 of m0 from another bank.

Now that you know this, try again.

Dammit, I’m hanging on the edge of my seat awaiting the final steps needed for infinite money, and mustang19 hasn’t returned!

You dont owe anything. You made $50k with $1k. The $1m is technically a liability but its canceled out by your asset.

Well yes like I already said its legal ponzi scheme based on fdic bailouts

Dude.

Do you really think the only reason banks don’t make infinite money is because they’re too lazy and stupid?

Like, I bet there was at least one banker in history who was pretty greedy and wanted more money, and was willing to work hard to rip people off. Not work hard making stuff, that’s just crazy talk, but putting some effort into scamming people? That’s, like, what a bank IS.

Again, a fractional reserve is just a requirement that the Feds make banks undertake. They have to keep some of their money in reserve, they can’t lend out all of it. And if they fall under that amount the Feds don’t give them more cash. That doesn’t happen. Instead the bank is obligated to liquidate their assets until they come up with the reserve amount.

Yes, you can make money by borrowing money from Peter and lending money to Paul. The way you make that money is by paying Peter a low interest rate and charging Paul a high interest rate, and your profit is the difference between those two rates multiplied by the amount of money in play.

But to get the money you lend to Paul you first have to have money. OK, you got the money by borrowing from Peter.

You start with $0. You borrow $10 from Peter.

But you don’t have $10 now. You have $10, plus a debt of $10 to Peter, which puts you right back to $0. You have $10 cash, plus a $10 debt, which adds up to $0.

If you take the $10 in cash and lend it to Paul, then you’ve got a $10 asset in Paul’s debt to you and a $10 debt to Peter, which still adds up to $0.

The way you make money is that you’re going to pay Peter back $11 next month, but Paul is going to have to pay you back $12 next month, which means that you made $1. Did that $1 appear out of nowhere? No, because Paul has to actually pay you. And according to the Feds you can’t just lend out $10, you can only lend out $9. So instead of lending $10 and getting paid $12, you have to lend out $9 and get paid $10.80 instead. So instead of making $1, you’re only making $0.80.

And of course you’re assuming a risk, because if Paul doesn’t pay you back you still have to pay Peter back. Paul gets hit by a truck, and the money is gone, and you still owe Peter $10. So you better hope that your risk of non-repayment is pretty small.

Also, suppose Paul is a bank, and Paul had FDIC insurance. Well, then you’re in luck because now you get paid back. Free money! Except the taxpayers had to come up with that money, which means you and Peter. If instead you have FDIC insurance and Peter needs his money and you can’t pay, then the taxpayers will pay Peter instead of you. Good for you! Except, dude, you don’t get to keep the money. You’re bankrupt. The FDIC doesn’t give you the money, they give Peter the money. And instead of owing Peter the money, you owe the government the money, and they’re going to pick over your financial carcass for whatever scraps are left, which is probably not much. So you lose, Paul loses because he’s dead, the taxpayers lose, and only Peter wins, except he’s a taxpayer too, so he loses that way.

Going back to that bizarre example:

Bank 1 M1/M0 Assets: $10

Bank 1: On hand to loan out: $9

Bank 1: Must keep $1 on reserve

Total: $10

Customer 1: Withdraws $1

Bank 1: On hand to loan out: $8.10

Bank 1: Must keep $0.90 on reserve

Total $9

Bank 1: Hey Fed, we need $1 to replace this $1 this customer took. Send it over!

Fed: Heck no! You don’t have anything on reserve with us, so why should we give you money?

Bank 1: Hey Fed, can we borrow $1?

Fed: Sure. Where’s your collateral?

Bank 1: Collate…what?

Fed: Collateral. You don’t think we’re going to just loan you money without some assurance we’ll get it back, do you? Just make sure it’s worth more than $1

Bank 1: …uh, sure. How about this shiny pebble?

Fed: Nope.

They don’t get back up to $10. They might get that loan from the Fed, but they’ll need something to back the loan. And if they “collapse” as part of a scheme, the Fed as a creditor gets something they can exchange for at least that $1, rather than the crooks at Bank 1 running off with it. No money is magically created here, which is the part (repeatedly) mentioned is lacking in the story.

Small correction. FDIC is not publicly funded (though oversight is there via publicly elected officials). Member banks pay for the insurance from the corporation, which is part of a legitimate bank’s cost of doing business.

Actually, thinking on it, is mustang19 under the impression that the Fed is compelled to produce money to cover the reserve requirements of each of the banks? I suppose that’s one way this bizarre scenario begins to make sense, but it’s also complete bunk.

That’s true, FDIC insurance is supposed to pay for itself, and in practice the rates for the insurance are really really low, because it’s rarely actually needed.

It just isn’t the case that shell banks around the country go bankrupt frequently and their creditors get paid out by the FDIC. And it’s certainly not the case that those creditors are other banks holding thousands of phony shell accounts.

Yes, fraud exists, as well as stuff that’s actually legal, like buying a company with borrowed money, having the company borrow a bunch of money, paying the new owners of the company lots of that money, and then the company itself crashes and burns. See Toy R Us and Sears.

That’s still not a ratchet that will get you infinite money though, because you actually have to buy the company, and con somebody into loaning the company money. And sometimes people do end up in prison for stuff like this.