So there’s this company that used to make these semi-enclosed electric hybrid tricycles called “ELFs”: https://wefunder.com/organic.transit

That original company made and sold 850 of these, then floundered after the company was sold and production shuttered around the time of Covid. A few years later, the original founders are restarting production, this time trying to crowdsource funding from private investors.

I like their vision and product. I’ve never been in one, but I’ve dreamed of owning one for the past few decades — I’d much rather have something like this than a proper car. They’ve sold about 850 units previously. The current target unit price is $7500.

I doubt it would ever even get as popular as the Segway (and that crashed and burned), but within its niche of “urban commuters in bike-friendly cities”, I can see how it does fill a void. It would certainly make my around-town trips a lot easier relative to a regular bike, with no room for cargo and no shelter from the elements, while not being as heavy and expensive as a real car.

But all of that is just me thinking about it as a daydreaming would-be owner, not a careful investor.

In this funding round, they’re selling 2% of the company ($200k out of a $9 million pre-money valuation… that’s what that means, right?), and I’m considering investing $1000, more to support the idea than out of any real expectation of a return.

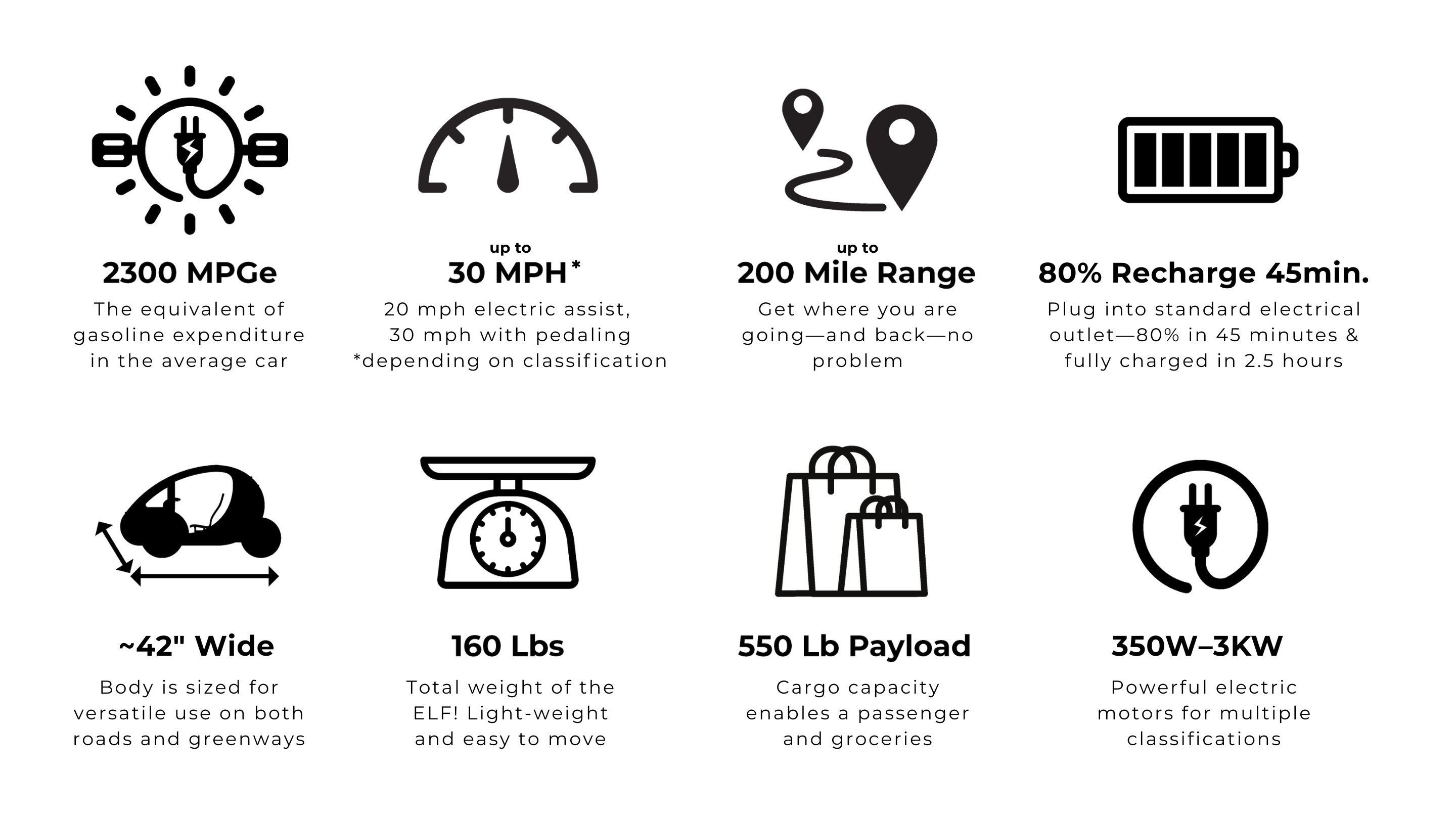

The design of the thing is charming and eye-catching and immediately likable (lovable, in my case), but also not entirely practical. The width of the thing means it’d occupy most of a bike lane, making passing difficult. Parking it would be hard since it can’t really be chained to a normal bike rack, and leaving it on the sidewalk would probably be frowned upon given its size. It’d have to compete for parking with real cars, which would annoy drivers and possibly invite vandalism, especially in red or purple areas. They did previously make a two-seat version, but it’s unclear if that will make a return. The lack of full doors make them less useful in the winter, although it still provides more shelter and comfort than a regular bike.

All in all, given these design limitations, I think there is a pretty low limit to how much marketshare it could realistically address, even if we just limit it to the micromobility-curious niche. It feels like the kind of thing that would be right at home in Portland, OR… and not many other places. It requires a perfect combination of culture, climate, and urban planning/bike-friendliness that not many locales have.

I don’t have any investment experience at all, mostly because most of the big companies and index funds tied to them seem outright evil to me, even the so-called “ESG funds” (environmental, social, governance). I wanted to try dipping my toes into investment via individual companies whose products I can at least personally vet and get behind, but I realize this is an extremely high risk endeavor for a minimal probability of return. It would be more like a donation than a proper investment, which is probably not very financially sound… surely, there’s gotta be a better middle ground approach that’s not so “pie in the sky eco-utopian fantasy”?

Tell me how stupid an idea this is. Or correct me where I’m wrong…