(Not really a fan of the more formal structure of GD, this may be political in nature… but it’s also economics… and Lord knows I don’t want to throw this in the Pit. So here we are, in IMHO. Oh, and this is probably long. I am never going to get the reputation as the Alexander Pope of the SDMB, so sit back and enjoy. And respond.)

AS THE reader probably knows, there are a current rash of stories about anti-vaxxers dying of COVID, from accountants to radio show hosts to police officers. Please see the bottom of this post for some examples.

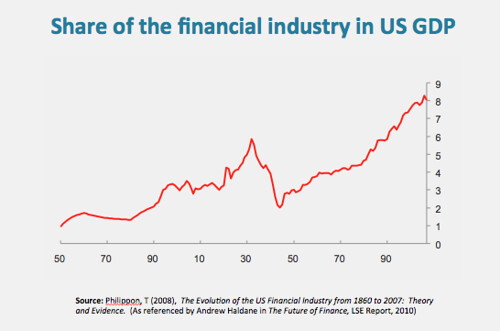

And, as you may know, I’ve written a number of posts criticizing the modern form of capitalism, the form which came into being starting around 1975 with the popularization of the Laffer curve, kicking off a policy trend which I refer to as the ‘financialization of America’, but is more commonly referred to as “Reaganomics”. One simple chart, an elephants tail if you will, of this phenomenon:

Took a hit in the 1930s but by 1970 the financial sector had rebounded to Gilded Age levels. It wasn’t enough, apparently!

As our reward for the dismantling of the New Deal safety net… as minimal as that was, tbh… brought about by the financialization of America, the companies most poised to profit from trickle down and supply side economics developed a vast array of ‘wealth building’ and ‘financial protection’ products designed to Bring You Peace of Mind by Covering Your Family’s Needs Even At The Worst of Times… or so we hear on the endless USAA/NYLife/MetLife/etc internet, radio, and TV ads. Products such as:

Life insurance

Health insurance

401(k)

Financial Advisors

Annuities

IRA’s

HSA’s (Health Savings Accounts)

Real Estate Investment Trusts (REIT)

Mutual Funds

Money Markets

Student Loans*

Subprime Loans*

All of these and more have been pushed to the fore while the defined benefit pensions and full-coverage health plans of the pre-financialization years (1945-1975) are no longer available to hundreds of millions, especially if your entire working life was spent in the American non-unionized private sector.

Including me. And, most likely, you.

Instead, we were given choice. Competition. Freedom.

Instead of a paternalistic company taking a flat 8% of your income to fund your retirement, you now have the freedom to decide what percentage… if any!.. you will fund to your retirement.

You buy that life insurance policy that you think you need, but that won’t prevent you… for the rest of your life… from being bothered by companies and salespersons calling/emailing/texting, all of them competing for your business.

You’re funding that 401(k). Time to make some changes! But your options are limited, your choice between options already pre-selected for you by your company’s HR department, the plan options, more. And if you decide to go it alone as a private investor, good luck as the multiplicity of options… and those competing against you… can make this an extremely daunting affair. Better go with that ‘medium’ risk option on the 401(k) and see if you can squeeze by on a 4% contribution.

Which brings me to the point:

The Venn diagram of people who are dying of Covid for ideological reasons and those who believe in this system… while not a circle, as the joke goes… must have some strong correlation. (Or not, and I am interested in data-driven arguments that covid-conservatives and financial conservatives are not related.)

So… these people who are dying. They’re setting up gofundme’s. Wives are scared because they have no breadwinner. Appeals for money and charity appear on Facebook, Twitter, IG.

I’m interested… @octopus, @Sam_Stone, @D_Anconia… I have heard all of you preach the same Gospel of financial reliance, the one I, too, was raised on. I know at least one of you bragged of your financial acumen during the COVID crash of March 2020, and you are the staunch conservatives who do answer for economic issues on this Board, so I have some questions to pose.

(And, of course, to everyone else as well.)

This is happening to your own ‘team’, the people also steeped in the ideology of self-reliance, savings, personal responsibility, and financial acuity.

Therefore:

-

Does this imply a failure in the system, or a failure of the assumptions behind the system? In other words, are the products shit or is the idea that the great mass of people can be financially responsible/educated/disciplined on the individual level… is that idea shit?

-

Your ideological cohorts are killing themselves, and the capitalist products above are failing their families. Does this concern you, that they are killing themselves via lies about Covid? Does it concern you they are leaving behind financially devastated families? Does it concern you that the system may have failed these people?

-

What about the products? Regardless of their faults as individuals, should not the power of the market have made these products irresistible even to the low-information consumer? Shouldn’t the power of innovation made them… better? Why didn’t they have life insurance, if they are clear-headed about the world? We’re all going to die. Why didn’t they have sufficient savings… what is it we’re supposed to have, 6 months minimum? Why don’t they have sufficient savings to handle this emergency, allowing the survivors to transition?

These people had good jobs!

And, please: I understand you don’t know why the specifics about these individual cases. But as a general rule, why do you think the most vocal supporters of capitalism among the middle class are failing to take advantage of the benefits of capitalism?

Was it a failure of training? Of personality? Of will? Morals? Products? System?

Thank you for your responses.

To me, what this shows is that American capitalism is also failing the very people who believe in it the most, but have the ability to defend against it the least. It’s a financial epidemic on top of our ‘freedom’-driven Covid pandemic. It’s a goddamned shame. It’s a fucking catastrophe. And it’s even more evidence, as if more is needed, that the economic theories of choice, competition, and freedom uber alles which has been foisted upon us by a party of grifters is fundamentally broken.

But we know what I think. What do you think? Why are middle class conservatives dying without the life insurance and savings they know, as conservatives, to invest in?

*It’s probably unfair to list two loans as “wealth building products”. But goddamned if student loans and the sort of shit loans and financial products which caused 2008 aren’t sold as a means to boost your earning potential/lifestyle, so I’m going to include them. If you want to argue, go ahead, I’ll just ignore ya’. ![]()