Since most 401Ks got out of company stock, the biggest risk is not contributing or being forced to withdraw funds. And most of us are covered by a defined benefits plan, Social Security. You can get suboptimal returns depending on when you start taking money out, but you can’t really screw it up too badly.

The net cost per thousand is $3.60 while the net costs per thousand for the “do it yourself” options range from $0.08 to $9.80. Most of the “do it yourself” options are between $2.50 and $6.80, so the targeted funds are right in the middle.

Did they raise it? Just because they ask for it doesn’t mean they do.

As for the subject header, maybe they think God will provide? Who knows.

I didn’t check - but Idoubt it. Certainly not from our family - those of us who could afford it would rather spoil our own kids/grandkids than participating in spoiling hers. Point is that setting up a GFM doesn’t necessarily mean the people doing so lack resources.

( or even had the expenses. My sister’s ex-husband died earlier this year. As my nephew is his next of kin ( the half-sibs are only about 10) the arrangements fell to him. Ex-BILs sister set up a GFM for funeral expenses and did not give my nephew all the money raised which wouldn’t have covered the entire cost anyway)

Good point. In general, if you had $200k to invest, you’re better off investing it and paying rent. You may not make as much overall in income, but you’re far better protected from vagaries in the real estate market.

But… people still need somewhere to live, and few people have $200k on-hand to invest, while many have the ability to get a mortgage for $200k. So it’s imperfect, but it’s the best many can do considering their circumstances. Most don’t have the patience or discipline to pay rent and sock away money for investment, but they can manage to pay a monthly mortgage. And after a few decades, they own an asset outright that they can live in, sell, or rent out.

It’s maybe not optimal, but it’s a better deal than most available to the average person.

Hey, @bump~~

Happy birthday!!

Happy birthday!!

Thanks! I appreciate it.

Sorry for the delay in responding - I got involved in helping move my niece to Corpus Christi, then the Karen Carpenter thing took a week of my attention, etc.

It can appear that way, but the OP was more interested as to why those who are ideologically most invested in the capitalist system are not taking advantage of it. Is it their fault, is it the system, is it the products themselves?

I didn’t really provide ‘data’, per se, but the vast majority of these stories had mentions and links to GoFundMe’s, etc.

I don’t think most of us are that good at predicting disaster, but I do agree with the position that making your government as impoverished as you can make it is a recipe for disaster.

Mystification, “an obscuring especially of capitalist or social dynamics (as by making them equivalent to natural laws) that is seen in Marxist thought as an impediment to critical consciousness”

For example:

It is thought normal that one should struggle when they are young. It is OK to not pay kids, especially teens, a living wage. It’s saying it’s fine to saddle 18 year-olds with 5 figures of student debt, while also saying it’s OK to pay those same 18yo’s $2.09 + tips at Buffalo Wild Wings.

“Hey, I was broke after I went to college and had student debt and I turned out OK - why should anyone be any different? That’s just the way of things. You struggle, then you succeed because of your struggles.”

By this and many other arguments (you can come up with them yourself if you’re an American) you get a group of people who literally believe that the system should be punitive, it should make people struggle.

And that’s our current retirement and health insurance systems: they are designed to pick and choose winners and losers based upon ones acumen in using the products listed in the OP. Hence this thread.

So, I was in the financial services industry for a few years, and the items listed were things we were supposed to sell - Life insurance, investment advice, 401(k) roll-overs, IRA’s and Roth IRA’s, etc. My apologies, I should have made it clearer that this sentence was referring to the list above it.

And, yes, we were trained to think of these as wealth-building products and services. Even your 10 year term policy. ![]()

Good point. Should I just go ahead and setup mine in advance?

Thank you for your reasoned response, and I can agree with much of it. Not too sure what is meant by birth dividend, however.

Yeah, I think I addressed this in my later post, where I showed that pretty much nobody participates in these products/plans in the manner in which we should. Americans as a whole don’t fund our 401(k)'s enough, we don’t have life insurance, we don’t think about how to annuitize our money, etc.

I have an edition of Liars Poker with a foreward by Lewis saying he was disappointed that too many young people took the wrong message from the book - they read it as a fun romp through Wall Street not a criticism of the system, and they used the book as inspiration to have similar careers.

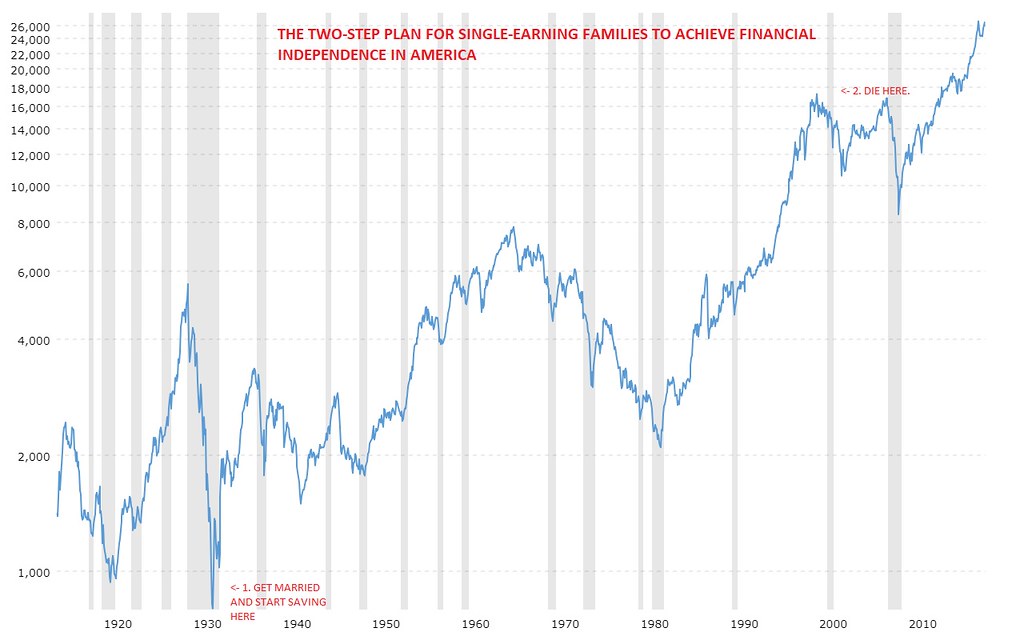

Oh, no, I completely understand. Stock market returns are really more about timing than many understand, or even want to believe. There is a common mantra out there… you see this on LinkedIn and other low information social media platforms ( ![]() )… about how you can never lose money long term in the stock market.

)… about how you can never lose money long term in the stock market.

Well…

The above chart is the DJIA adjusted for inflation, the chart on a log scale. My grandparents, lucky them, literally started buying stocks at the bottom of 1931 (they were married in April that year) and passed away at the height of the internet bubble, fully believing in the American dream. Why not - as you can see from the two red comments on the timeline, it worked.

But… to your point… look at the person who started investing in 1935 and died in 1980. They pretty much lost all their gains earned from 1955-1975 and other than reinvested dividends, the American system just failed them. All because they started 4 years later than my grandparents and died 20 years earlier.

See above re: timing. Sometimes, the recession sells you! ![]()

… will return later, have stuff to do.