The basic idea behind “supply-side economics” and trickle down “theory” is that if more money goes to the wealthy, they will invest it wisely thus growing the economy, the effects of which will “trickle down” to the working sod in the form of more jobs, higher wages (because of a demand for workers), benevolent philanthropy, et cetera, and that revenues lost due to the lower tax rate will be offset by greater economic growth. (This is often compared in false dichotomy of just giving money to poor people who will spend it on worthless stuff like food, rent, and entertainment where all value will be wasted.) So as long as you find the right saddle point where lower taxes produce sufficient growth such that the resulting revenue is the same, like making more of a cheaper product gets higher sales. Or, as Bullwinkle would say, “Hey, Rocky! Watch me pull a rabbit out of my hat!”

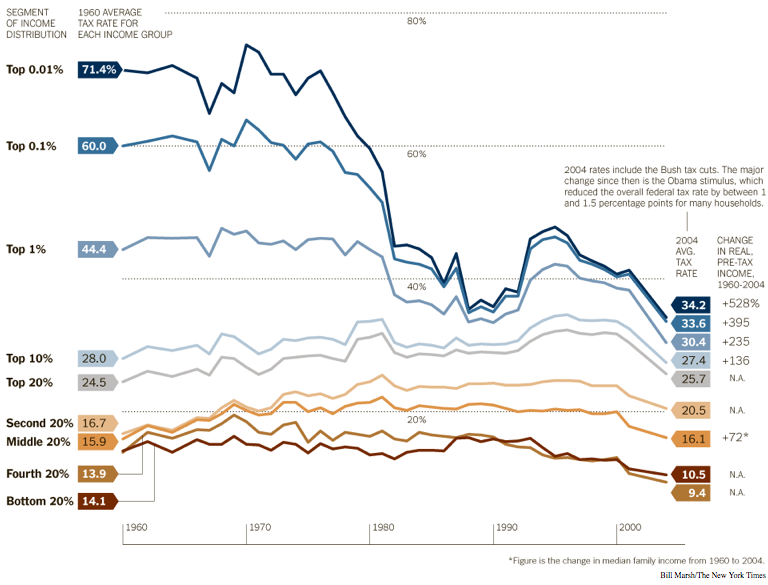

In the actual reality that we occupy, even by the laughably loose standards of macroeconomics there is no data or evidence that shows the “theory” of trickle-down economics to be valid. Although associated in common memory with Reagan and his “voodoo economics” (George H.B. Bush’s words, not mine), it goes back to the late 19th century, and the term was actually a sardonic joke by satirist Will Rogers about how if the rich were allowed to accumulate all wealth, some would escape their reservoirs and “trickle down” to the poor like water before “trickling back up” to the rich again. Reagan’s spin on it was to reference the Laffer Curve which was literally a napkin sketch based upon no data whatsoever, or even scales that would let you test it against actual economic indices.

People believe that lower taxes for higher income people is good for the economy because

- They’ve been told so by someone they believe without question,

- They don’t know anything about economics, or

- It is a suitably vague justification to hide behind while the fleecing the public.

There is, of course, an argument that investment in research, technology development, et cetera is a public good, and thus, the acquisition of capital for these efforts is a public benefit. However, if you look at actual technological innovations and money that supports research in universities, you’ll find government funding behind nearly all of it just because no single wealthy individual or company is going to invest the modern equivalent of many billions of dollars into basic research in order to build a sufficient base of knowledge to develop actual salable products.

Wealthy individuals, of course, want to keep wealth out of the hands of middle and lower classes because if they have more money and are able to purchase more stuff, it will result in inflation which reduces the value of their holdings. Their notion of “growing the economy” is that their private wealth should increase rather than that it should “trickle down” and enrich others. A rising tide may raise all ships, but if you are a king the last thing you want is for uppity peasants to start building their own towers.

Stranger