I was thinking something,lets say that you had one or two million euros or dollars,wherever you live and you had enough money to live a life that is a little above average,but still nothing too much,for instance if the average salary is 2000 dollars per month,your millions would give you 2500 dollars per month until the end of your life,would it be safe to live only on that or would the prices change after time and salaries rise for instance to…3000 dollars,which would then make your 2500 little…? For instance in my country (Serbia) about 70,80 years ago you were able to buy about 15-25 breads for the same money for which you can buy just one bread today,but then again when you think about it,now it is a economical crisis and everything is more expensive than it should be,so perhaps cost would actually go down over time?

50 years is in the range of impossibility to predict. Too many variables compounded by too many opportunities for chaotic change.

I would bet that the basics of life (rent, basic foods, etc.) will cost much the same as they always have in terms of percentage of income or wage rates. A loaf of bread might be 1 foobar or 10,000 foobars, but that price will be within a narrow historical band of foobar/hour wage rates.

Everything else? Who knows. It would be pure guesswork with no fewer than 3-4 likely options.

I suggest you read up on the concepts of inflation and deflation, but to explain them briefly:

You’re correct that prices and salaries change. They do so for a variety of reasons. If prices and salaries generally rise we call that inflation. With inflation money sinks in value. If prices and salaries generally decrease we call that deflation. With deflation money increases in value.

For various reasons deflation is bad for an economy, and so is rapid inflation, but a little inflation is a good thing overall, even if some aspects may be undesirable, so you’ll find that in most functioning economies in the world prices have steadily risen and salaries as well, over the last several decades.

Well, that certainly is something you need to consider when retiring. In the US, the annual inflation rate is something around 3% on average (although it’s been less recently during the economic crisis.) So, in 50 years, for your money to be worth what $2000 is today, you’d need around $8750.

Think in terms of man-hours. The typical amount of money a labourer would get for an hour’s work.

If it took 1 MH to buy a loaf in 1950, you would probably find that it took a little less today. That would be due to mass production and distribution. 100 years ago in the UK, it took a year’s labour to buy a TV. Now it costs about 65 hours. This is because the price of a TV is much lower.

Serbia is not typical. You have been through wars and revolutions more than most other countries, so it is hard to compare, but I bet if you look at the basic unit of the man-hour, things are not so different.

Cite please.

I stumbled upon this map

http://www.numbeo.com/cost-of-living/gmaps.jsp?indexToShow=getCpiAndRentIndex

It shows cities by their relative rent costs. You can click on the city and get a breakdown of what it costs to live there.

But 50 years from now? I’d say San Francisco will be even more expensive as it gentrifies, along with Oakland. It may be easier to forecast for a specific city, is my point.

“I would bet…” pretty much obviates the need for a cite. It’s my guess, you see.

You can look up indexes of wages, basic costs and man-hours per loaf and while individual ones change over time, there’s a strong center band to both.

What TVs might have cost 100 years ago, BTW, is cheerfully idiotic, but I was going to point out the more relevant example of mobile phones - unavailable at any price within current lifetimes, then a very expensive perk of the wealthy, then expensive on a consumer scale, and finally near-universal within a narrow cost band. What that’s an example of is an unpredictable or chaotic element; no one in 1950 was seriously considering what a consumer in 2010 would spend on a pocket phone. So you can always find things like TVs and cell phones and so forth that have drastically dropped in real-dollar cost… but they’re essentially meaningless as economic predictors.

What does it cost to stay housed, clothed, fed, well and at least modestly comfortable? That’s a verity that transcends millennia, and the only things you can try to apply long-term wage/loaf indexes to. On that scale, and excluding times of war and other chaos, you’ll find that the “cost of life” has remained in a remarkably narrow range.

No, you’re forgetting that the Really Effin’ Big One of 2038 leveled the bay cities to the ground and our involvement in the Canadian War kept us from rebuilding it, so it’s the Mad Max wasteland of old 20th Century fiction.

Silly, yes, but I’d bet a Serbian OP understands exactly what I mean.

Did they have TV’s in the UK in 1914? That surprises me. No wonder they were so expensive. Not much worth watching I bet.

That’s what I’m asking a cite for. Please enlighten me about where to find this information.

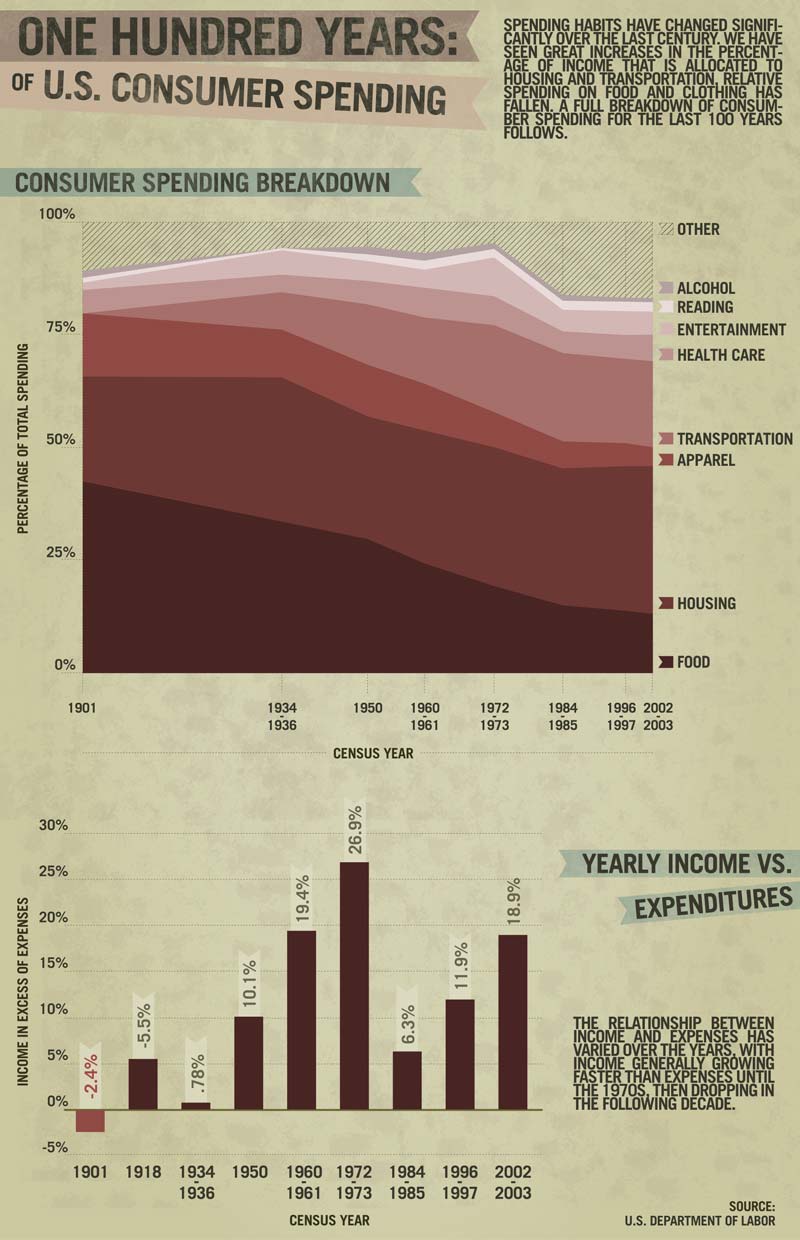

This site has data showing as a percentage of income the amount people in the US have been spending on food has been going down pretty steadily since the great depression.

http://mjperry.blogspot.com/2009/07/spending-on-food-at-all-time-historical.html

This page has a breakdown of lots of things like housing, clothing along with food.

OK - but “*on January 26, 1926 Baird gave what is widely recognized as being the world’s first demonstration of a working television system, to members of the Royal Institution and a newspaper reporter from The Times, at his laboratory in 22 Frith Street, Soho, London. Unlike later electronic systems with several hundred lines of resolution, Baird’s vertically scanned image, using a scanning disk embedded with a double spiral of lenses, had only 30 lines, just enough to reproduce a recognizable human face.”

*

I used that to illustrate how consumer products drop in price, while staples like bread carry on much the same.

I did. Look up wages across any span you care to investigate; look up categories of basic living costs across the same span.

The problem is that such charts involve many layers of guesswork and supposition; there is no one hard-and-fast answer about any of it. It can be difficult to find adequate data on wages and item costs much past the late 19th century, so you choose your data points and you choose your suppositions and you get to a conclusion that likely suits your starting prejudices.

In general, I’ve found that honest and neutral investigations of wages and living costs tend to find them stable across eras and ages. That’s all I can say, because you might have different criteria about who is “neutral” and who is not. An awful lot of writeups in this area, from newspaper columnists to Ivy League economists, tend to start with a conclusion in mind and they choose data and assumptions that lead to that conclusion.

Thanks for the links. BLS and the CPI also has some interesting information on changes in cost of living.

Save early and often. Compound intrest is your friend.

No, this is the kind of “analysis” I warned about, that seems to make sense but turns out to be vague and slippery once you try to pin it down.

[ol]

[li]It’s somebody’s blog, not any kind of validated reference.[/li][li]The underlying USDA link has gone bad, meaning there’s no easy way to validate the data used. (Was it ever accurate? We don’t know.)[/li][li]It is reportedly the percentage of **disposable personal **income people spend on food, which is quite different from “percentage of income” as you state it.[/li][/ol]

But it looks good at first glance, no? All you have to do is find hard definitions of two or three other economic terms and you’re good…

They didn’t start selling TV’s in the UK till 88 years ago.

My parents bought a 9" Bush B/W TV in 1952 which cost 80 GBP. My Fathers weekly wage was 10GBP.

I’ve never been convinced by this common statement. First because interest rates are typically low, barely beating inflation (and you typically have to pay taxes on the interests too). After a lifetime of compound interests, those 1000 you saved when you were 20 might have become 4000 but they’re worth $1250 after you deduce inflation. Not as impressive as it seems. Second because your income is typically low and your expenses high when you’re young, Saving is going to be difficult and will require a lot of sacrifices. When older, your income is typically significantly higher and you might own your house, have raised your children, etc…hence have much less expense, and saving a lot might be much easier.

I’m not saying that young people shouldn’t save, but I think what you said about compound interests is completely overrated.

That may be true of bank savings accounts, but putting your savings into securities (or even better yet, your pre-tax earnings into a 401K) is a totally different story. Assuming an annual return of 7%, that $1,000 that a 20-year old invested, without adding any more into the account, would become $21,000 when he’s 65. Even better, if the 20-year old also saves an additional $100 per month, he would have $363,901.62 by the time he retires.