It seems to me that in theory, a reverse mortgage might be combined with an annuity, so that if the calculation is made properly, the cost of the regular monthly payments are recovered when the house is sold upon your death.

Aargh! The two worst instruments combined into one poison package.

Both aimed at fearful risk-averse elderly victims.

Legal, yes. Ethical: no. Do your own diligence before signing up for anything like this!

Neither of the two are inherently bad things. In practice they often are, and are often chosen for emotional reasons over reasoned analysis, and sold taking advantage of that it seems. But conceptually they are both fine.

coming back to a topic debated earlier: DJT slowly (well last week was a leapfrog) eroding trust in the US as financial institution.

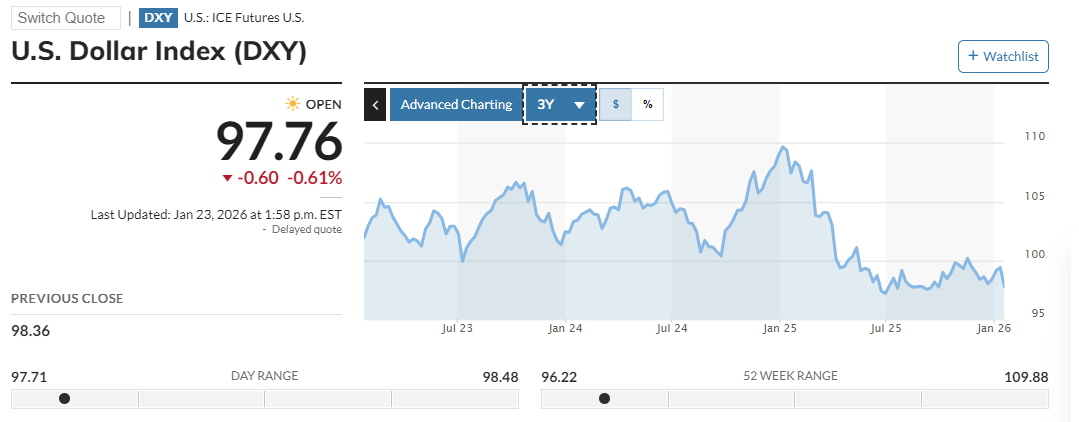

If so inclined, read the article, → I have strong feeling (reading between lines) that we have somewhat hit the iceberg (doble-pun not intended), while we are still partying like its 1999. It seems currently mostly limited to the fixed income instruments, but there is somewhat of a subjacent massive sell-off (beyond this weeks headlines) going on, again, just look at the dollar index (-10% in a year, -1.69% in past 5 days) …

I can’t imagine that this trend will turn around anytime w/ Trump at the helm (the dollar IS 100% tied to Trump). AND … and that is an important aspect: given its size, if institutionals take money out of the US-bond market and put it in other asset classes, that (-1%) of volumen in bonds might make (+10, 20 or 50%) in other markets (just look at: Gold ++++ , Silver ++++, etc).

So for my american friends, getting into investments that are NOT in US$ might be a thought, I’d seriously start bouncing around. I know I might catch some heat for this (for “my countryshitting”), but I find it often the case that people withing a country (esp. if the country runs the us$) don’t perceive this, but the hard fact is, you ‘mericans got 2% poorer in the last 5 days because of ice, greenland and assorted cr@p granny is doing.

Thoughts?

Not inherently bad, perhaps. But they both almost often come with high costs and fees, and are frequently marketed to a vulnerable demographic who don’t have the experience and knowledge to evaluate them realistically. So I still say: if not a scam: pretty close to it.

I think a number of us have already said we’ve moved some money into Ex-US assets. I’ve been saving since about 1996, and when I first started out I had a worthy chunk (maybe 20%?) in foreign holdings. Around 2016 I put a major push into cleaning some things up (getting all my old 401ks into one IRA, converting a tiny vested pension into a lump-sump payout and into my IRA, etc).

At that time, I realized my ex-US had done absolutely horrifically compared to the US, and I converted ALL my Ex-Us holdings to mostly S&P 500. And from 2016 to 2025 I can say, with hindsight, that was 100% the right move.

In early 2026 I ditched my Nasdaq 100 (pigs get fat, hogs get slaughtered) and some of my S&P 500 holdings and moved them to a European index fund. A year on, that’s done quite nicely.

I also started deploying new money into the Russel 2000, because it should have less international exposure. Also, so far so good.

Regarding the dollar, I don’t doubt there’s a desire to get away from it. But as I have said, I just don’t see a viable alternative right now. BRICS are not exactly paragons of good governance, the Pound and Yen are too small, and the Euro isn’t one country, it’s 27 each with different priorities.

Also, look at the “all” data set. The dollar is still comfortably inside its long-term average, so as yet there is no reason to panic.

https://www.marketwatch.com/investing/index/dxy

FWIW, I am horrified and ashamed at what the US is doing, and there will be an should be consequences. But when the dollar represents about 25% of the world economy, and anything else that’s even close (Chinese RMB) is an even worse option, well you make do with what’s available.

a thought or 3:

the long-term avg. does not help or guide you. Jimmy Carter is dead and Trump aint.

Look at the very chart you mention, and see what happened from jan-2025 onwards. The same person will random walk run the country until jan-2028. We all know the chance of him stopping to do stupid things are nil.

Every new round of flooding the zone … will lead to a.) High-fiving in the administration and b.) more erosion esp. from foreign investors. You ‘mericans are “tied” to him … Foreign institutional investors not so much.

Of course, I could be wrong

Australian dollars are doing well.

I have no disagreement that in practice they are frequently exploitive.

And I suspect there are ways to borrow against the value of your house equity (reverse mortgage) with non exploitative instruments, and annuities that make sense for individuals who don’t want to afraid of longevity. I am not alone in thinking of delaying social security until 70 as a very attractive annuity, for example.

This is exactly why I took an annuity when I retired 9 years ago. I could have taken a lump-sum distribution from my built-up pension fund, or there were a choice of annuity distributions. I chose the lifetime payout, which keeps paying until both my wife and I have passed away. Given that both of our families have extreme longevity, it made sense for me.

The annual distribution, paid monthly, is about equal to a 7% annual return on the lump sum payout.

I am not a financial advisor. But I would say to anyone being given a hard sell on either of these instruments: be careful. The sharks are circling. That’s about all I’m going to say about this.

Now how about that silver price spike?

It’s a set payout or it can change over time (COLA/CPI)?

see post 1284 … ![]()

it seems that investors sidestep investment in US-bonds (fear for shenanigans of DJT) - so all other investment classes are pretty much booming (starting wallstreet, metals, etc…) since they are fed by a firehose of $$$.

Russia is dumping a whole lot of gold, since its price is so high now, to finance the war, so the extreme upward-trend of gold is somewhat dampened by russia selling a lot. That is not true for silver, so silver is rocketing even higher.

Plus of course all the safe-haven thingy …

Set payout for the rest of our lives.

So rampant inflation could be a problem, certainly.

Up to you, of course, but - especially if you’re expecting to live for many more decades and don’t expect Social Security to cover your lifestyle - you might look at swapping over to some alternate plan that has less “shrinking ice cube” quality to it.

Or save a bit each month and try to grow that if the exit cost is too high.

I’m locked in for life on that plan. But I waited until 70 to start drawing SS. And I have a 7-figure IRA.

I think I’ll be okay.

Thoughts on day to day volatility? None. Investing ought to be considered a long term process and if thinking long term even a few years to a decade isn’t something to stress over.

my worries are more people who might retire in 2, 3 or 5 years (or are already retired and living off their nestegg) … sure if you got 20 years to go, the rising tide will lift all boats …

but if you are just a couple of years shy, you have

a.) normally quite a good amount of $$$$$ invested,

b.) little time to recover

which makes this scenario somewhat “nasty” …

Agree with @Al128 - as a “safe haven” it’s the gold wannabe, and with gold so high it looks attractive to many. My understanding is that many follow the historic ratio of gold to silver prices and by that metric the last two years of a gold run had gotten silver historically somewhat cheap relative to gold. No where near as cheap as it was in pandemic days but still relative to other times.

Again there are also other factors at play for each too.

There is always that possibility though. If one isn’t diversified in their holdings then of course there is risk. Has that ever not been the case in investing? I just think it’s counterproductive for those who do invest, as opposed to day-trading or speculating, to worry about the day to day.