…I don’t know what its like over in North America, but here in New Zealand and much of the rest of the world if I want to transfer payment to another person here, I ask them for their bank account number, then I log into my bank account, enter their bank account number into my payment details then I pay them. Same with vendors.

When I have to “go off site” that normally involves a couple of seconds while a new page loads, then I fill out all the details as normal or click “pay with PayPal”, there is another pause for about a second before it takes me back to the original screen.

The process is so seamless now that you barely even notice you’ve been taken off site at all. It’s designed that way. So what value is there to Twitter to bring it all in house? In all the time I’ve had a Twitter account there have been a total of zero times I’ve had the need to pay anybody else, and zero times I’ve had the need to pay a vendor.

So what is the target market here? Who is going to be using this? It won’t be existing users. Because very little of this sort of thing is actually going on now on the platform. At the very least he would have to launch this alongside a revamped Twitter Shopping (which was effectively sidelined last year when the team got fired) so that people would have something to use payments for. And in order to make it viable you would need a significant investment in marketing so that people would know that it even exists.

I don’t think the idea of an “everything app” is an inherently bad idea. But that app isn’t going to be Twitter.

I mean: it could try. But my online shop uses Paypal and Stripe. They are convenient, trusted in the marketplace, and just work. Can you sell me on why I would switch/add Twitter as well?

I think we’ve discussed this before. Twitter would need to prove that any new system would offer better long-term value than what the newsrooms currently are already doing. That we haven’t already seen a move towards micropayments seems to indicate the value isn’t there. The media aren’t going to completely overhaul their existing business models because Elon needs another revenue stream.

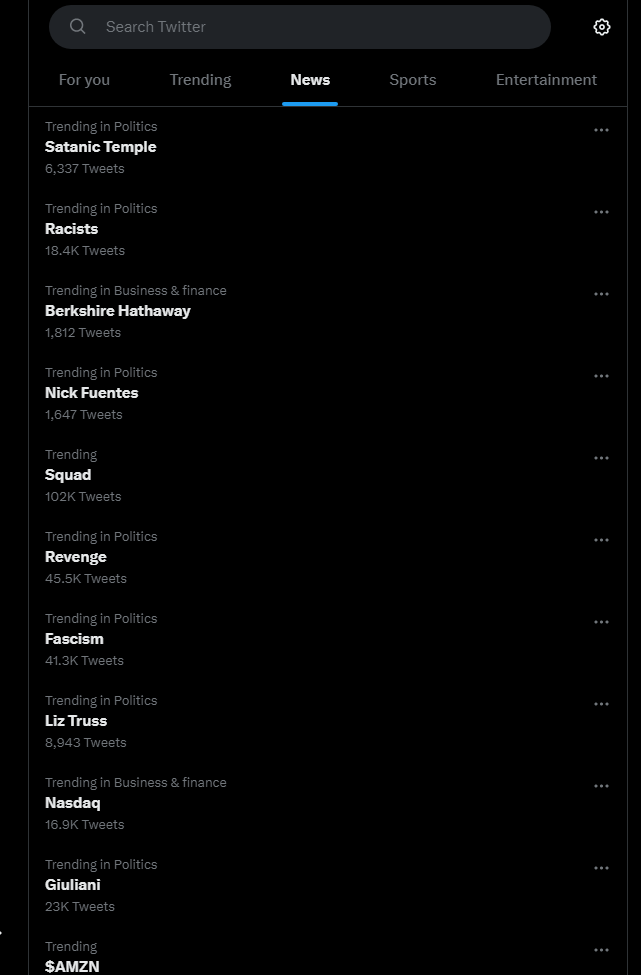

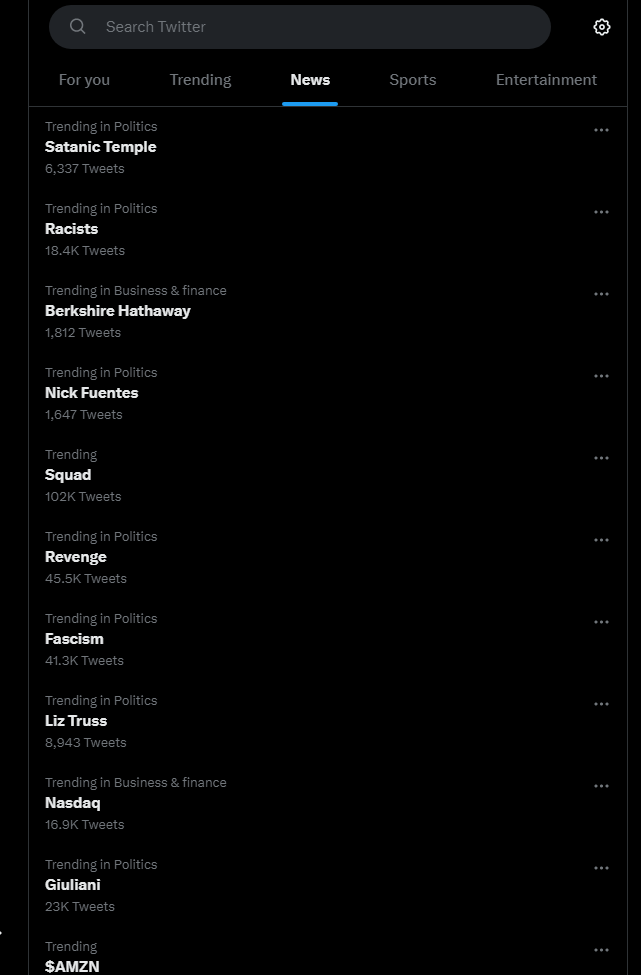

And here’s another important thing to consider. This is my news recommendations as of a few minutes ago:

Can you see how many New Zealand news topics the algorithm is recommending to me? Zero.

And when I click on “Satanic Temple” does it take me to a range of newspaper articles posted by their respective news organizations that would enlighten me on why it happens to be number one on my news recommendations? Nope.

If I was a news organization and if this is the kind of news recommendations that would pop up on my feed, I’d be running quickly in the other direction. That Nick Fuentes (the well-known white supremacist, anti-Semitic, Holocaust denialist, founder of Groypers AKA the Groyper Army AKA racist far-right activists/provocateurs/trolls, and Youtuber) is the fourth trending “news” topic is not a great advertisment for newsroom micropayments. And the complete lack of localization would mean that no newsroom here in NZ would even consider it.

And the thing is: it didn’t use to be like this. The news recommendations used to be actually useful and used to point to the actual news. Now its just a game of Mad Libs.

I suspect Youtube has nothing to fear from Twitter. Twitter video is still unstable, with about at least 5% of videos that show up on my feed not even loading properly and the quality being mid at best.

And with both uploading longer videos and 1080p videos being restricted to only Twitter Blue users, that means the majority of videos currently being shared are all shorter and lower quality, currently making Twitter a terrible showcase for video.

Any single one of these ideas might be viable. But they are all impossible to develop in an environment that is unfocused, chaotic, that thinks its being “agile” but in reality is just flinging shit at the wall. You can’t develop a product without doing the market research first. A “good idea” simply isn’t enough.