Antifa… I mean, my dog ate my cite.

Sam has also indicated he is a Milton Friedman monetarist, which is, ah, let’s say, remarkable, in this day and age.

Shocker: I also believe in free markets. The horror.

And I refuse to take economic criticism from an ‘anarcho-Communist’. Only idiots and idealogues believe that crap. It’s like taking advice on astronomy from an astrologer.

Much like the idiots who believe “supply side” and “trickle down” economics.

Oooh… Buzzwords. Do you actually know what they mean? I’d love to hear your description of trickle-down economics and supply side economics, and why they don’t work. Be specifiic.

Supply side is where business is given tax breaks, reduced regulations and other incentives to increase production while leaving the consumer base without the extra money to buy the products.

Trickle down is thinking that by further enriching the highest income levels, they’ll throw a few crumbs to the working class. You know what else trickles down? Urine.

Yeah, that’s pretty much what I thought you’d say.

‘Supply side’ isn’t about ‘the rich’. It’s about removing barriers to wealth creation through business, and it applies equally to your neighbor the landscaper and your local corner restaurant as it does Jeff Bezos.

In fact, giant corporations love regulations and taxes, as they are large enough to handle the legal load and they have lobbyists to twist them to their benefit. They simply push the taxes down to their customers. Supply side mostly helps small businesses and entrepreneurs who cannot afford lawyers and accountants for regulations and who are chronically short on capital for expansion. Job creation suffers, snce small businesses create the majority of new jobs.

So high tax, high regulation economies depress the middle class and slow down entrepreneurship and small business formation, but they have plenty of oligarchs and giant corporations. They become less dynamic and lower growth, but the rich do fine. For example, Europe is full of old money wealthy people. America’s billionaires are mostly self-made. And there are more billionaires in Europe than America, despite their high taxes and regulations. Or because of them.

Ever wonder why the fortune 500 votes for Democrats, while the Chamber of Commerce types vote Republican?

As for trickle-down, those ‘scraps’ include cell phones, air bags, electric cars, cheap airplane travel, abs brakes, yada yada. All things developed for the rich, which trickled down to everyone. But trickle down is more than that - it’s also about retaining dapital in the private economy so that investment and development take place. Capitalism takes capital, and capitalism works. It works far better than anything else we ever tried. And capitalism IS trickle-down.

I woulda gone with,

‘They’re the greatest economic ideas humans have ever had and humanity owes a great debt to the man who thought them up, Ronald Reagan PBUH!’

You know Sam, I literally have a degree in economics, have written extensively on this Board, and my Substack is dedicated to the moral and economic failure which is modern conservative economics, and I have done all this… without a single word in response from you, so let’s talk.

The definition of ‘trickle down’ is when a plutocrat pisses on you. Cite:

I live in a state which is a conservatives wet dream and we can’t keep the power on during the cold or the heat.

The theories themselves are crap, mere justification for the enrichment of plutocrats, 40+ years of conservative policy implementation has brought horrible results, and the entire rotten, morally broken edifice of ‘supply side economics’ needs to be cast aside for this country to survive.

Which is not your concern, of course, not living in the United States. So stop telling us that we need more shit. Because that’s what Reaganomics is.

But, yeah. Let’s talk. What do you wish to discuss?

Laffer Curve.

Drawn on a napkin in a DC restaurant in 1974, the Laffer curve… a simple supply/demand curve applied to tax rates… has become gospel and, by itself, represents of of the towering intellectual underpinnings of the modern conservative movement. The general idea, as perverted by conservative politicians and their ill-informed lackeys, is ‘to raise tax revenues and release the power of innovation, one needs to cut marginal tax rates on the wealthy’, which has been even more simplified as ‘cutting taxes spurs economic growth’, all accepted as Truth without even bothering to see if it is correct.

Hint: it is not. This Cato study, in 1981, explains how it can fail:

Effectively, the author concedes: if government revenues do not rise, and the government does not cut spending, a situation will arise where the government must issue debt. This invalidates the benefit received from the Laffer curve as in order to pay back the debt, the government will require a tax increase in the future, resulting… the author notes… in no net benefit.

But, wait! He saves the Laffer curve literally with an emotional and ideological appeal which has nothing to do with economics and should not be in an academic paper.

I mean, this is embarrassing babble:

‘There are many other good reasons for cutting taxes. Taxation takes from us what is ours and denies our freedom to use our income in any peaceful way we see fit. It denies our civil liberties’2 and reduces our material well-being’

Which is why I call this, Sam, ‘faith based economics’. Because the data doesn’t support it, but y’all take it as an article of faith that your unproven statements are fundamental axioms and you use appeals to emotions like the above even in academic studies. ![]()

This is so wrong I’m worried you don’t have a grasp of the subject.

Trickle down refers to flows of capital, not innovations. It is presumed that the increased flows will result in investments and innovation/inventions, and this presumption is used to sell this horse hockey, but the next innovation one can definitively prove was a result of pissed-on economics will be the first.

Look at the incoherence of this Investopedia explanation:

![]() So does having extra money cause one to spend or save?

So does having extra money cause one to spend or save? ![]()

Note, Sam, this incoherence is conservative thought and practice defined:

… to incentivize the wealthy, one must give them money

… to incentivize all others, money should be taken away

Another problem with the Laffer curve in practice, is that it only measures the impact it has on government revenue. If you are a plutocrat getting more money every time taxes are cut regardless of where you are on the curve, and you believe in a malignant philosophy which states ‘the worst thing you can hear is “I’m from the government and I’m here to help”’, what do you care about the impact your lobbied-for tax cuts have on government revenue?

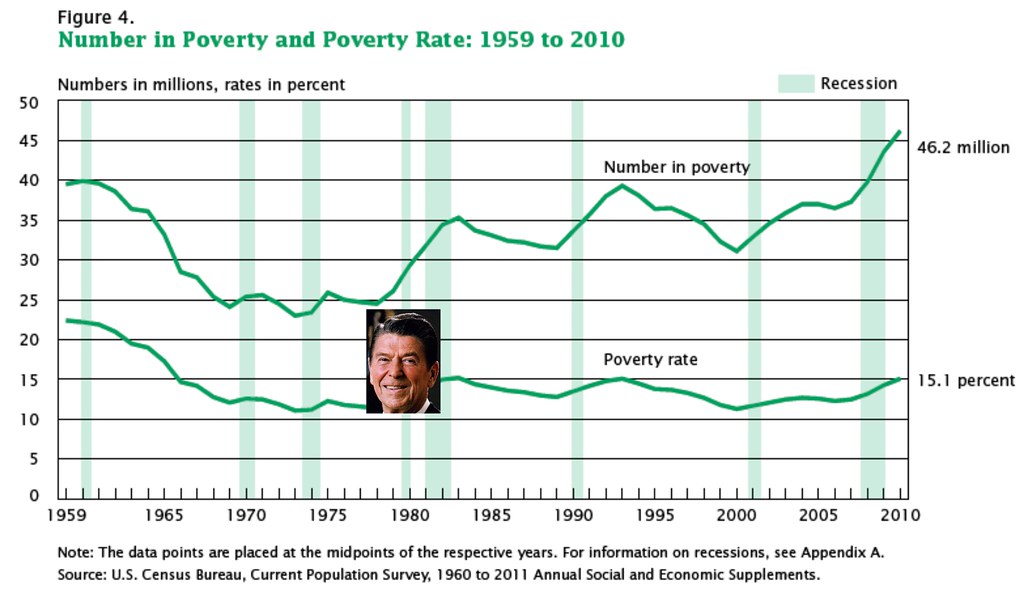

What is the individual cost of this madness?

Sam mentions some gadgets which somehow resulted because of trickle-down economics (TDE), but he hasn’t really explained that TDE was necessary for any of these things, especially given Western civilization’s rather impressive track record on creating technical shit, especially from 1455-onward. In fact, we can safely say that a non TDE world gets us to 1980s levels of civilization, which isn’t bad. Hell, we had dial-up back then.

But I digress.

What has TDE cost us, the individual? See, this is the one thing you don’t have to worry about, Sam, because you don’t live in a country dumb enough to enact these ideas across the entire societal spectrum. Tragically, however, I do.

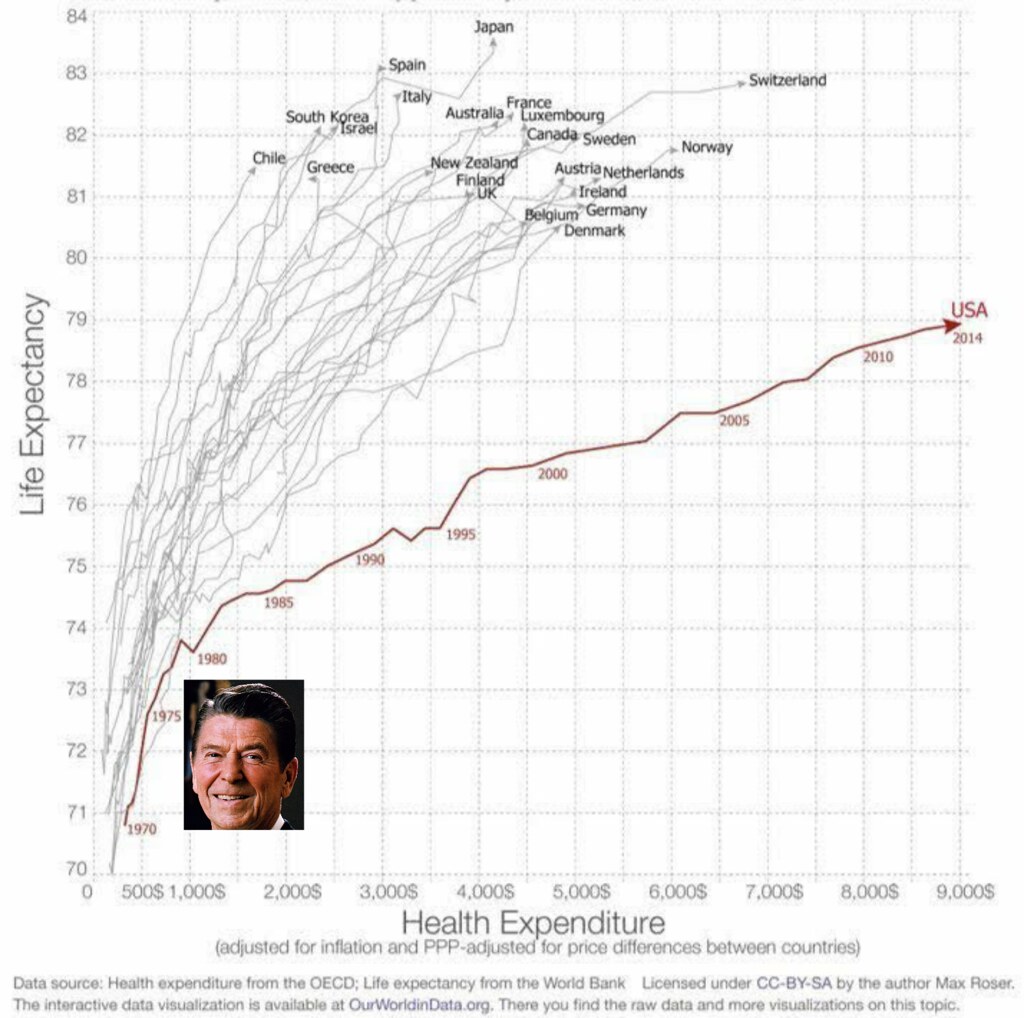

Let’s look at this graphic again:

I posted it upthread, but want to reintroduce it to this discussion. This graph shows the disconnect between productivity growth and wage growth of production workers which started in 1975 and accelerated in 1981.

And before I get accused of posting Lefty cites, here is the Heritage Foundation with a similar graph showing the same relationship:

(We’ll go into “Total Compensation” and what an anti-worker crock that concept is later.)

OK, so there is a disconnect between productivity growth and wage growth, one which didn’t exist before Nixon and was greatly boosted by Reagan. Much of this is due to the financialization of America, the process beginning in the mid 1970s of turning ownership into streams of revenue. Using junk bonds is an example of the financialization of America. The inability to buy a DVD, requiring us to stream movies we once could own is another. Student loans, an especially pernicious form of the concept. Derivatives. RMBS’s. Microsoft going from Office CD’s to Office 365. The list goes on.

But why does this matter?

The Rand Corporation looked at the above gap and decided to commission a study, released in August 2020, which did nothing but measure the economic impact of this change. on the various class levels here in America. They did not spend time exploring why this had happened, they just wanted to know the financial impact.

This 69 page report (found below) breaks down the impact by income percentile, race, gender, state, and more. There are well over 100 different tables, and I chose the most comprehensive for this post:

Here’s how to read this chart, looking at line 2 (MEDIAN):

In 1975, the median individual (he/him) earned the equivalent of $42,000 in 2018 dollars. In 1979, the same. In 1989 his income increased $1k to $43k (but I thought the 80s were unprecedented prosperity? But I digress again…). By 2000, $47k, a dip during the Bush years, and in 2018, this person made $50,000…. $8,000 more than they were making in 1975.

Had his income increased the same as it did ala 1945-1974 (“Counterfactual”), his income would be $92,000.

Therefore, the median individual income grew only 16.0% as it would have under 1945-1974 growth rates.

Now let’s look at the 99% (last line):

In 1975, the average 1%er (TOP 1% MEAN) took home $289k equivalent. $292k in 1979, $467k by the first year of the Bush1 admin, more than doubling in the 1990s to $1.1M/yr, ending up at $1.384m in 2018.

Had their income increased the same as 1945-1974, they would be earning $630,000

Therefore, the average 1%er grew their income at a rate 3.211x more than they would have had we kept to 1945-1974 rates.

Time Magazine has an excellent write-up on the financial catastrophe your economic ideas have had on America. Some quotes:

It’s now 2021 and it’s worse. Federal Reserve policy since Jimmy Carter has done nothing but exaggerate this problem, one which wasn’t slowed by the Democratic administrations of Clinton or Obama (so don’t give them a pass on this either) who themselves accepted the ideological framework of modern conservative economics, all driven by that laughably simple Laffer curve.

Sam, this “trickle down” you love has represented a $50,000,000,000, $50 trillion, transfer of wealth from the middle class and lower to the top 10% since 1975.

From me. From all the other Americans on this Board. But not from you, let us never, ever forget this fact, Sam, as you pitch for bad ideas which you never have to suffer under.

To be quite frank, I am perfectly willing to give up Itunes and ABS brakes for $40k more a year. In fact, I’m pretty damned confident that these things would exist even if it weren’t for that fucker, Reagan.

@JohnT, that was a thing of beauty.

Can we do an analysis of the changes Reagan made to federal financial aid and how it impacted opportunities for low income students to access higher ed and the crushing student debt problem, and it’s impact on personal wealth?

First, @JohnT, wow! Nicely done.

@Sam_Stone, man, your reading comprehension blows. @running_coach said nothing about Supply Side Economics being about the rich. He referenced the rich in the Trickle-Down part of his post.

Second that.

Third. I look forward to Sam tying himself into knots trying to ignore it without looking like he’s ignoring it.

Shit, quickly:

One of the conservative arguments to the productivity/wage graph is, they claim, that it only captures hourly compensation and doesn’t account for the rich diversity of benefits offered by our munificent employers. The Heritage Foundation calculated this and built the handy graphic below (also shown above):

Let’s talk about how silly that argument is:

-

The gap is 107%. Even with 30% benefits added on, we are still down 77%. AS SHOWN ON THEIR OWN DECEPTIVE* GRAPHIC!

-

The “growth” in benefits argument is a crock, the increase in benefits seen above entirely supported by the increase in the cost of health insurance. In fact, the increase in health care “benefits” masks the decreasing per employee contributions companies are making to retirement plans via the 401(k).

And here’s how that little con works.

You work at BigCorp for $60k/year. BigCorp pays 75% of your $500/month health insurance policy, or $375/month. You pay the $125 remaining. All things being equal, your after-insurance cash income is $58,500 ($60k - ($125x12) and your benefits income is $4,500 ($375x12), for a post out-of-pocket insurance cost of “Total Compensation” of $63,000.

InsureCo meets with BigCorp execs, says “We have to raise the price of insurance by $200/month.” Your insurance is now $700. BigCorp says “Hey, don’t worry, we’ll still cover 75%!”

Amount BigCorp pays: $525, up $150/mth from $375.

Amount you pay: $175/mth, up $50/mth from $125.

Your cash income drops to $57,900, because you now pay $50/mth more in insurance costs. However, your “benefit income” increases by $1,800 to $6,300/year ($525x12), meaning your “Total Compensation” post-out-of-pocket-insurance is $64,200.

You take home $600 less. Your “Total Compensation”, however, increases by $1,200 solely because of a rise in insurance rates which caused you and BigCorp to spend more on InsureCo’s insurance.

See what happens when you use a Total Compensation calculation like the Heritage guys above? Companies can literally charge you and your employers more for benefits, you get less take home pay, and yet that can be considered a “raise”.

Bullshit. Here’s some Econ 101, Sam: Cash is King.

This is why Total Compensation is a complete fuckery, mean to confuse those who don’t want to do the (slightly) detailed math. Or read the chart, like the one above which is presented as a defense of this concept while still showing a 77% gap.

They literally, Sam, expect you to hear what you want to hear and not see what’s directly in front of your own eyes. This guys whole argument still has a 77% gap, but he still tries to convince us that what we’re seeing IN HIS CHART is not what we’re seeing.

C’mon. You’re better than this blatant intellectual dishonesty. You’re better than Reaganomics.

Cite:

*How the graph is dishonest, let me count the ways:

- You see no baseline prior to 1974. This wouldn’t matter, except for the addition of the “benefits” variable. How did those behave in 1945-1974 is kept hidden from us.

- Note that they literally placed the top value at 100% and showed incomes declining 7%. They could have just as easily adjusted for 2012=100, and have the top value be 107%. This is a bit deceiving because most people skimming this chart will think “oh, productivity doubled” when, in fact, compared to wages it rose 107% not 100%.

I would also like to note that the “Goods Produced vs Goods Consumed” argument suffers from a fatal flaw when it states:

“To discern whether compensation has kept pace with worker productivity, economists use the prices of the goods or services that employees produce.”

The assumption here is that all revenues and profits are generated from operating activities. Since 1975, this is increasingly false for almost all Fortune 500 businesses, which see growing, significant revenues via the income statement lines “gain (loss) due to financial activities”, “extraordinary items”, and the like.

Oh, and thank you all for the kind words.

Not really my topic, but from what I see, it’s either GHWB or Clinton who initiated the policy change which made student loans very attractive to private lenders in 1992, 1993:

To be fair, there’s a whole host of bad-faith actors involved in this, from US News and World Report to colleges pushing their branding via increasing their tuition cost (makes them appear more valuable - “surely they wouldn’t be charging $65k/year if they weren’t worth it… right?”, to private equity firms willing to put trillions of debt on the back of 19 year-olds who are being trained to work in the Reaganomics-dominated income environment described above, to every Presidential administration since Johnson who allowed this problem to fester and metastasize into yet another capitalist cancer on OUR lives.

Cite for chart:

https://www.thirdway.org/report/student-loans-and-graduation-from-american-universities