Energy prices go through the roof. Convulsions in the Middle East disrupt the oil supply, and alternative energy sources fail to materialize.

Energy

My interest in energy policy in the 90s was limited to critiquing my parents’ thermostat setpoints and occasional reading about hot new energy technologies in pop science magazines. I don’t think I’d heard of Wired when The Long Boom was published. But a few years back, I fell into a role where I consult about new energy technologies, an area full of whiz-bang predictions that don’t pan out. So I jumped on this topic because it’s fun to compare old predictions with reality.

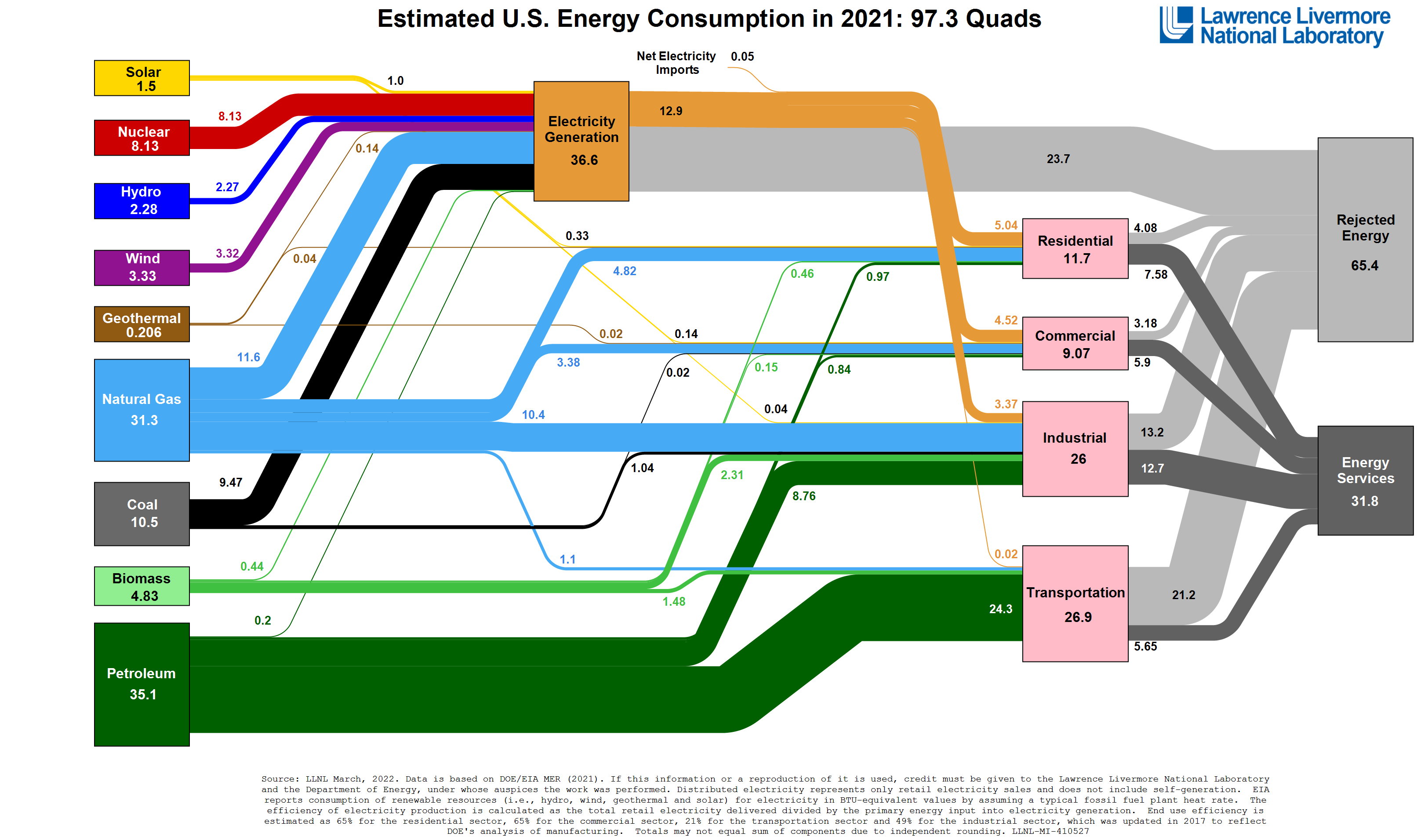

We harness fossil fuels, unstable nuclei, solar radiation, natural movements of wind and water, and leftover thermal energy from the earth’s formation to generate electricity and heat. You can see the latest mix in the United State, published annually by Lawrence Livermore National Laboratory, here:

A similar (interactive! but not embeddable) Sankey diagram for world energy is offered by the International Energy Agency.

These sources are, to varying degrees, moveable, storable, and interconvertable, but not always on a reasonable time scale or cost. They are thus sensitive to supply or demand shocks, such as wars or pandemics, respectively. You might see local disruption now and then due to refinery maintenance, bad weather, or cybersecurity incidents. Hurricanes regularly shut down refineries. In February, 2021, unwinterized power sources and cold weather resulted in widespread blackouts and sky-high residential utility bills in Texas. Just a few months later, hackers compromised software that manages a major pipeline system, leading to panic buying and gasoline shortages. In California, Pacific Gas and Electric Company has implemented blackouts during windy weather to prevent fires. And thus we see a current high price for oil (and it’s product, gasoline) as supply from Russia is disrupted. Likewise prices dropped when COVID lockdowns started and demand cratered.

Our energy supply is clearly fragile and subject to temporary disruption. But long-term prices have been relatively stable. So I wouldn’t call anything “through the roof”. Yes, gasoline is expensive as I write this, but it was similarly high (real, i.e. after adjusting for inflation) in 1980, 2008, and 2012 (.xlsx from the Energy Information Administration). Real residential electricity prices have been relatively flat. Real residential natural gas prices saw some elevation 15 years ago, but are back to the late-80s/early-90s baseline. All this despite domestic energy consumption increasing by a ~third over the last 25 years (PDF from EIA.)

The shocks thus far have all proven temporary. But that could change. We derive about 80% of our energy from finite fossil sources, both in the U.S. and globally. Despite doom-and-gloom predictions about peak oil dating back to at least the 50s (and the subject of sometimes contentious discussions here on the SDMB), the United States produces far more petroleum and natural gas today than 25 years ago. And conventional oil production did peak roughly as expected in the 50s. But advances in imaging, directional drilling, and hydraulic fracturing resulted in increased production from shale formations starting in the late '00s. This new production is expensive, and low prices in and after 2015 burned multiple highly-leveraged production companies, leading to a more steady-as-she-goes approach today despite elevated prices. But the U.S. has gone from net imports of millions of barrels per day to rough parity between imports and exports over the past few years. How long that can (or should) last might be a good topic for a new thread.

Renewable energy has slowly and only partially materialized, currently comprising about 13% of domestic energy production, up from 9% in the mid-90s, with most of that increase in the past decade. But the sun and wind are intermittent sources, requiring storage or peaker plants as penetration increases. Both options mean additional capital costs. Peaker plants are typically lower-efficiency than baseload power plants. Storage suffers from round trip conversion losses, but this is an active area of research. From pumped hydro to batteries to liquid chemicals, different storage technologies have advantages for different use scenarios and locations. Have geography amenable to pumped hydro? Most places don’t. Need daily, four-hour burst of electricity when people come home from work and the sun is going down? Batteries might do the job. California is rapidly expanding its lithium ion battery grid storage. Want to generate electricity locally and export it overseas? Think about water electrolysis and ammonia synthesis. Japan and Australia are exploring this option. The popular science news is full of grand claims and excitement about new energy storage technologies, and I encourage curious but confused readers to start threads on any that catch their eye that they’d like to learn more about.

But what about vehicles? That’s what disruptions to the oil supply have affected most, historically, and that’s still the case today. Battery electric vehicles (BEVs) comprise only a few percent of new vehicle sales, barely outpaced by hybrid electric vehicles. True, that’s up from pretty much zero. But even with high penetration, turnover will be slow; modern vehicles are long-lived. The batteries with the highest energy and power densities contain elements with limited supply that often come from countries with cruel and unusual labor practices. They can, in theory, be recycled, but they’re not designed for it and that is not yet a widespread practice. That said, batteries keep getting cheaper. Factors such as the performance of BEVs and their low maintenance requirements make them attractive to many drivers with access to charging infrastructure. But not everyone parks near an outlet, and opinions remain strong and mixed.

What of the much ballyhooed “hydrogen economy”? The idea is that electricity generated from renewable sources will be used for water electrolysis to produce hydrogen, which can be transported and used as a fuel for applications where batteries are less attractive (e.g. heavy-duty transportation, aviation, re-generation of stored energy, maybe even light-duty vehicles.) Mechanical energy can be generated from hydrogen fuel through a traditional internal combustion engine or turbine, with modifications to account for the different flame speed. Or, electricity can be generated directly in an electrochemical cell, e.g. a proton-exchange membrane fuel cell (PEMFC). Like combustion, PEMFCs operate through the net reaction of hydrogen with the oxygen in air. But instead of mixing the reactants and burning them, hydrogen is oxidized at the anode of an electrochemial cell to protons, which pass through an electrically-resistive but proton-conducting polymer membrane electrolyte, where they react with oxygen at the cathode to form water. Other cell chemistries are available and I’m happy to go on about them elsewhere. Fuel cells work and are getting cheaper, but they’re still impractically expensive for most applications. While PEMFCs contain expensive precious metal catalysts, much of their cost is actually in decidedly unsexy balance-of-plant components like blowers and thermal management, which are expected to come down in price as volume increases. Fuel cell electric vehicles (FCEVs) remain barely more than a dream today, but they do exist, with Toyota’s Mirai the most well-known in my circles. Even if FCEVs take off, hydrogen is currently produced by steam reforming of natural gas and release of the carbon dioxide product. There’s been much talk of blue (in which the carbon dioxide is captured and stored) or green (from electrolysis powered by renewable electricity) hydrogen, but limited action. So many are skeptical of hydrogen’s place in the grim green future. I’m cautious but more sanguine than many. Even if hydrogen isn’t used extensively for transportation, it has potential for many industrial applications or for use in transportation indirectly by storing energy in other chemical fuels.

Let’s revisit the sidebar:

Energy prices go through the roof. Convulsions in the Middle East disrupt the oil supply, and alternative energy sources fail to materialize.

Convulsions here or there or elsewhere do periodically disrupt hydrocarbon supplies, but prices eventually settle down. Alternative energy sources have progressed, but still have a long way to go. The drop in the cost of solar panels and wind turbines suggests a continued upward trend in renewable generation. That and improvements in storage technologies may gradually lessen the impact of disruptions to fossil energy production. And while I’ve been focused on supply, there are environmental implications to these technologies as well. And whether these improvements happen fast enough to head of looming environmental disaster is another question.